How To Apply Section 504 Home Repair Loan And Grant Program?

- Your current income

- Current asset

- Your debts or credit

- Validation of your ownership of the house you want to repair

- Information of the contractors who have been selected to go for repairmen of the house.

Full Answer

What do you need to know about 504 Loan program?

- The CDC 504 Loan is selective about borrowers and usage of funds. ...

- While borrowers can use funds to refinance eligible business operating expenses, there is a maximum 85% loan-to-value, meaning such operating expenses may not exceed 25% of the total value of ...

- Prepayment penalties exist during the first half of the loan term. ...

What grants are available for home repairs?

“These grants ... repairs and replace obsolete manufactured homes. This helps ensure that older New Yorkers, disabled adults, veterans and people who are on fixed or limited incomes can remain living safely and securely in the place they call home.”

Who can qualify for a 504?

Section 504 does not specifically list which disabilities are included, but it is usually limited to those with long-term disabilities, such as attention deficit and hyperactivity disorder (ADHD)—although some impermanent disabilities, for example, while recovering from a medical condition, may qualify in the short-term.

What is the idea Act and Section 504?

The Individuals with Disabilities Education Act (IDEA), and Section 504 of the Rehabilitation Act of 1973 represent attempts to improve the living conditions of those with disabilities.

What is a 504 home repair loan?

The USDA’s Section 504 Home Repair program is a valuable source of support for many rural homeowners who are financially struggling. It provides an opportunity to ensure your home is not only suitable for your family but well-kept in the long run. If you have further questions about similar loan programs, consider reading our article on government loans to learn more about options for repairing your home.

What is Section 504 loan?

The Section 504 Home Repair Program , also known as the Single-Family Housing Repair Loans & Grants, is a loan program managed by the U.S. Department of Agriculture (USDA). It’s designed to help elderly homeowners and those who struggle with very low incomes. You can determine if a household is very low-income if it’s below 50% of the median income within the area. It also targets and helps accommodate the needs of those who struggle with disabilities.

How much can you get on a 504 loan?

They can also be used to remove any health or safety hazards from your home. Your 504 Home Repair Loan caps out at $20,000, so that’s the maximum amount you can receive.

How much can you use a home repair grant for?

You can only use grant funds to remove any health or safety hazards from the home. The Home Repair Grants have a lower available maximum amount as well at $7,500. However, you may be able to combine your grant and loan for a total value of $27,500.

Is the rate of substandard homes in rural areas higher than the national rate?

According to the U.S. Department of Housing and Urban Development, the rate of substandard homes in these rural areas is higher than the national rate. Chief among the individuals affected is seniors, who tend to have a lower income in nonmetropolitan areas than seniors do nationally.

Who Manages Section 504?

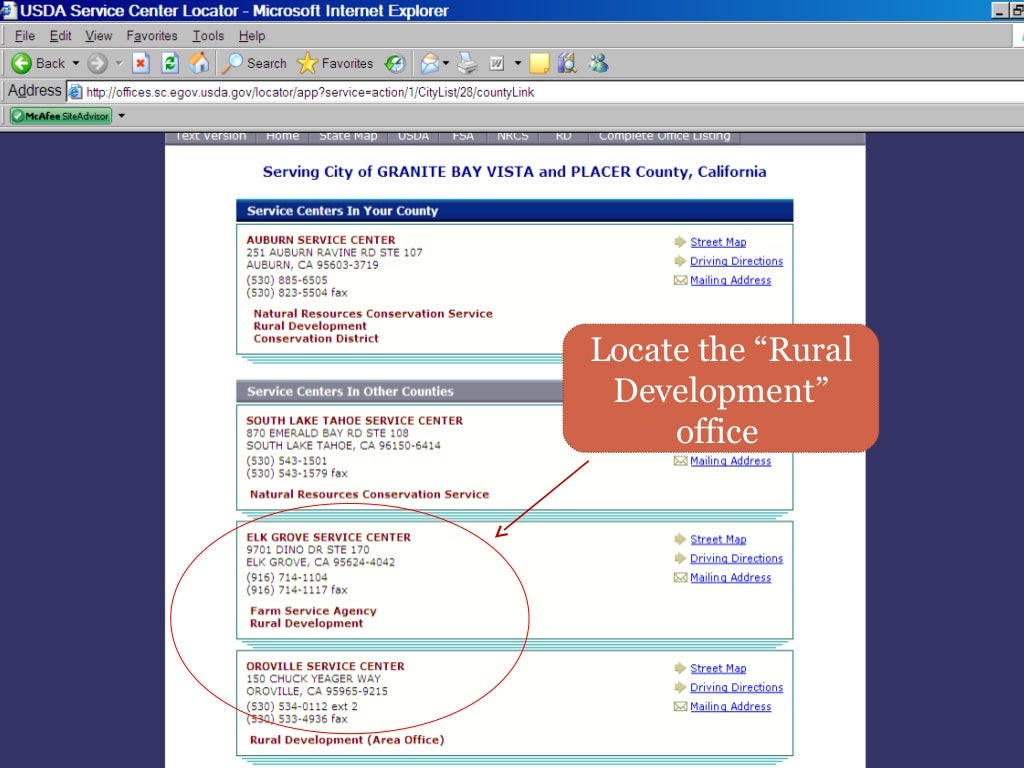

Section 504 is housed under the umbrella of the United States Department of Agriculture, and specifically, falls under the domain of the USDA Rural Development Department. And while you’ll often hear it simply referred to as Section 504, the technical term for this program is the Single-Family Housing Repair Loans and Grants Program.

Qualifications Necessary to Receive Section 504 Money

Before you ever begin to go through the process of filling out paperwork for Section 504, you need to understand if you’ll even qualify for the money in the first place.

Section 504 Loans

Of the two options available to you, the Section 504 loan will give you more money for more projects. Whether you’re attempting to fix safety hazards, or you’re needing to make some updates, the loan is going to be the option you’re most likely to qualify for.

Section 504 Grants

A grant is money that you don’t have to pay back. Thus, Section 504 grants are funds gifted to you in which you never have to think about reimbursement. You use the money, and that’s it.

How Much Money Can You Get Through Section 504?

There are a number of variables that play into how much money you’ll receive through Section 504, but the chief factor to consider is whether you’re looking at the loan or the grant option.

Additional Section 504 Funds

Sometimes you can combine a Section 504 loan and 504 grant together. The USDA can be choosy with when they permit this and when they do not, but should they approve you for such an amount, you could then qualify for up to $27,500.

What You Can Use Section 504 Money For

Section 504 funding is specifically labeled as funds that’s to be used for home repairs to modernize a home – particularly if these repairs correct an otherwise hazardous situation. A sidewalk with holes that presents a very clear tripping hazard could thus potentially be a project Section 504 funding could be applied to.

How long does a Section 504 loan last?

The loan can be repaid over 20 years, and the interest rate is fixed at 1%. You don’t have to pay back a grant, but before you’re given any funds, you must sign an agreement that says if you sell your home that’s been repaired with a Section 504 grant within three years, the full amount must be repaid.

How old do you have to be to qualify for a home repair loan?

At least one person living in the household must be age 62 or older and unable to repay a repair loan.