So Like I said earlier, to calculate the after repair value (ARV) of a property, we need to:

- Find the average sales price per square footage of sold properties (comparable or comps)

- In the last one year

- Within one mile radius of the subject property and

- Multiply by its square footage

...

- TRC – Total repair cost;

- ARC – Average repair cost per sq. ft. or sq. m; and.

- AREA – Area of the property that requires repairs.

How to find after repair value (ARV) of a house?

- Condition of the property (upgrades, finishes, features, etc.)

- Age of the property (ideally no more than five- to 10-year difference in age)

- Size of the property (square footage should ideally be within 250 square feet of the subject property)

- Construction and style of property (Craftsman, wood frame, brick, etc)

How to calculate pvifa manually?

- Whenever possible, make extra payments to reduce the principal amount of your loan faster. ...

- Consider the interest rate on the debts you have outstanding. ...

- You can find loan amortization calculators on the Internet. ...

- Use the $10,000 figure and calculate your amortization over the remaining term of the loan. ...

How to compute after tax salvage value?

The straight line depreciation for the machine would be calculated as follows:

- Cost of the asset: $100,000.

- Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost.

- Useful life of the asset: 5 years.

- Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount.

How to calculate after repair value (ARV)?

After Repair Value Formula. The following formula is used to calculate an after repair value: ARV = ACSF * TSF. Where ARV is the after repair value ($) ACSF is the average cost or price per square foot that repaired homes have sold for in the area ($/ft^2) TSF is the total square feet (ft^2)

Is market value the same as after repair value?

The difference is the following: Current Market Value = The value of a property in its current condition "as is". After Repaired Value ( ARV ) = The value of the same property if it were 100% perfect condition.

What is the 70 rule in house flipping?

The 70% rule helps home flippers determine the maximum price they should pay for an investment property. Basically, they should spend no more than 70% of the home's after-repair value minus the costs of renovating the property.

What does repair value mean?

Updated on July 03, 2020. In the real-estate flipping business, After Repair Value (ARV) is the value of a property after you have conducted repairs and are ready to sell. It takes into account the total cost of repairs and the estimated value of the home.

What is loan to after repair value?

What is a Loan-to-ARV? (After Repair Value) Loan-to-ARV is a unique financial term specifically related to fix-and-flip real estate investments. It's designed to help investors understand the value of a loan in relation to the future appraised value of the asset which is being purchased.

What is the 50% rule?

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

What is the 2% rule?

The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To apply the 2% rule, an investor must first determine their available capital, taking into account any future fees or commissions that may arise from trading.

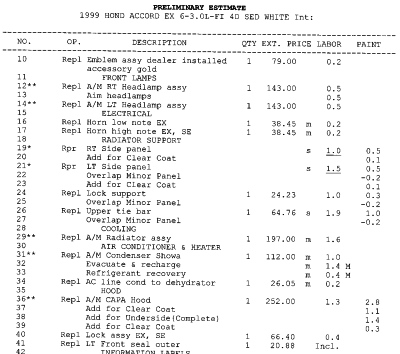

How do I estimate home repairs?

First, compile the total list of materials needed, and record a high and low price estimate for each. Once that's done, add both columns of numbers to get the total cost for both high and low. Then add the two totals, and then divide by two to get the average cost.

How do you estimate wholesale repairs?

0:006:48How To Calculate The Cost of Repairs On Any House In 60 Seconds!YouTubeStart of suggested clipEnd of suggested clipIn order to analyze the numbers on a distressed property either to fix and flip or wholesale to aMoreIn order to analyze the numbers on a distressed property either to fix and flip or wholesale to a fixing clipper. It's important you know how to quickly determine the cost of repairs.

How do you calculate a 70% rule?

Divide it by 70. In the rule of 70, the “70” represents the dividend or the divisible number in the formula. Divide your growth rate by 70 to determine the amount of time it will take for your investment to double. For example, if your mutual fund has a three percent growth rate, divide 70 by three.

How do I get ARV on Zillow?

0:2313:01How To Figure Out ARV Of A Property In Minutes (PT.1, USING ZILLOW)YouTubeStart of suggested clipEnd of suggested clipPeople that are not Realtors. And they need another way to find their comps Zillow is still a veryMorePeople that are not Realtors. And they need another way to find their comps Zillow is still a very good in a very accurate platform to find comps. For your properties.

What is ARV for houses?

ARV, or after-repair value, is the estimated value of a property after completed renovations, not in its current condition. House flippers commonly use ARV as a way to gauge the worth of a fixer-upper property, including how much it can be bought, and then resold for after repairs.

What does AVR mean in real estate?

March 28, 2022 February 9, 2021. In real estate ARV is short for after repair value, or the estimate of a property's value after all repairs and upgrades are completed.

What is the 70% rule in house flipping?

The 70% rule is a factor multiplied by the after repair value to create profit in real estate investing before buying into a deal.

How do you calculate an ARV?

Simply find the average sales price per square footage of sold properties in the last one year within one mile radius of the subject property…and m...

What is a good ARV?

A good ARV is subjective because it is only good if it creates enough profit that makes the deal worth the investor’s time.

Why should the current value of a property be valued by a professional appraiser?

The current value of any property should be valued by a professional appraiser to ensure that the correct value is calculated. Services of certified websites can be employed to find out or compare the value of the property with other properties in the market. It is imperative to collect maximum information like flood certification on the property so that the best price or value of any property can be determined accurately.

What is 70% ARV?

The 70% ARV rule is used to find out the maximum bid price of any property. The rule bids the 70% price of the expected selling price post deduction of the repair cost, hence ensuring that there will be returns of around 30% for the investors.

What is SCA valuation?

Real estate brokers and appraisers use the SCA to estimate market value by comparing and contrasting multiple properties. Investors often buy fixer-uppers, so this valuation helps you understand a property’s potential value—also called the after repair value (ARV).

What is margin of safety in real estate?

A margin of safety in real estate means buying below the true value. But the trick with Warren Buffett—or with any of us—is that “true value” is illusive. It’s an estimate. A margin of safety compensates for this lack of certainty by providing room for human error.

Is real estate valuation an educated guess?

You’ve made it through the three-step process! But before we end, I want to explain something very important: Real estate valuation is always just an educated guess. Even the best appraiser, broker, or investor can’t predict the future.

Can a professional appraiser send over comps?

A professional agent or appraiser can choose filters that pull the best comps. This is one of the reasons it’s so important to hire an excellent real estate agent—you need one who can send over comps regularly. If you are using a buyer’s agent for purchases, this is a reasonable request.

What is Value?

I found that the word does not carry the same “value” in the eyes of every beholder.

So Like I said earlier, to calculate the after repair value (ARV) of a property, we need to

Find the average sales price per square footage of sold properties (comparable or comps)

What is a good ARV?

A good ARV is subjective because it is only good if it creates enough profit that makes the deal worth the investor’s time.

What is After Repair Value in Real Estate?

After repair value (ARV) is the projected value of a property after it has been repaired, renovated, or updated.

How to Determine ARV for Real Estate

Comparable properties (or comps) are homes that are most similar to the property being renovated that have recently sold. Comps are easiest to run with access to the Multiple Listing Service (MLS).

6 Tips for Using ARV in Real Estate

For many real estate investors, establishing the after repair value is relatively easy. The trick is accurately estimating the cost of repairs and buying the right property at the right price.

What Is the After Repair Value (ARV)?

The After Repair Value (ARV) in real estate refers to a property’s value after renovating it and putting it on the market that is arrived at by considering the estimated home value and repair costs. It is more of an educated estimate than a book value and requires that you be informed about the house you want to flip and its value after renovation.

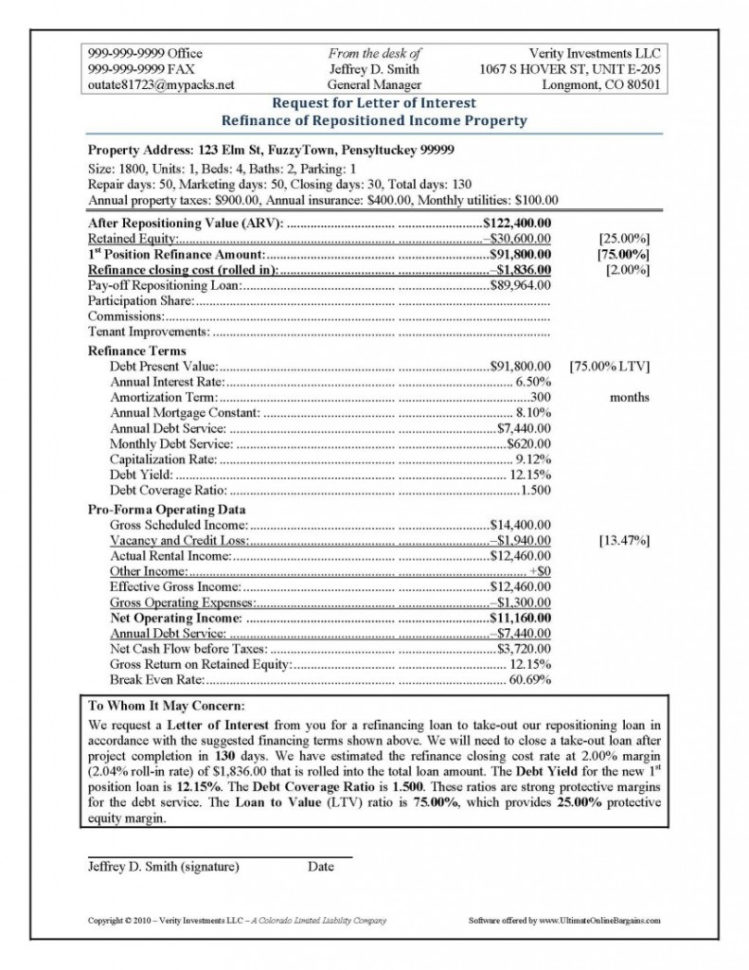

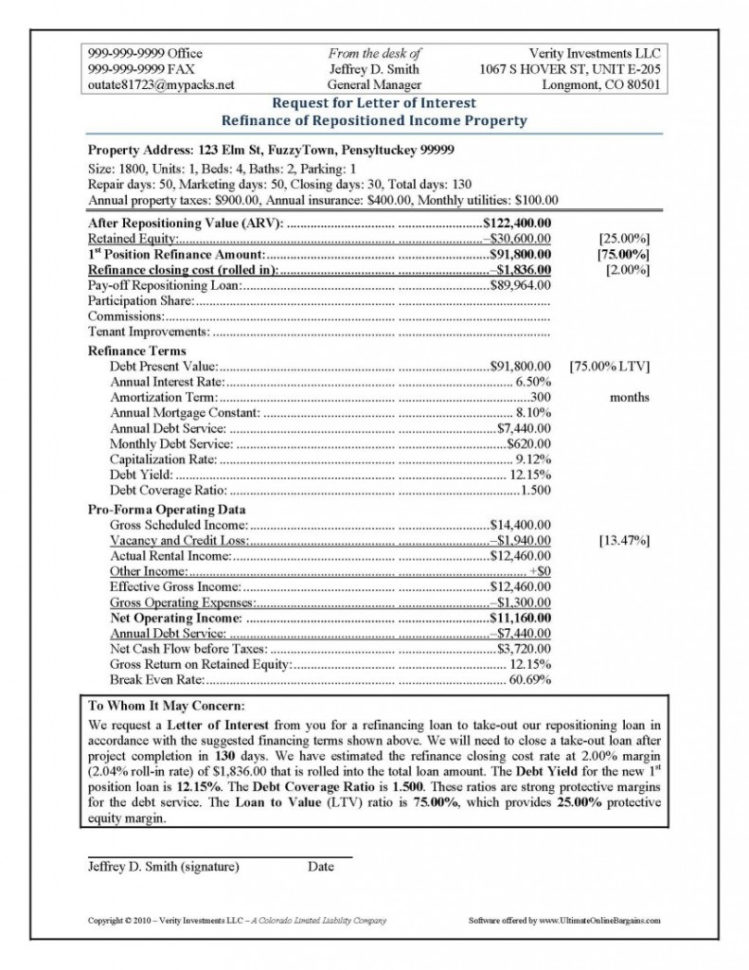

How to Calculate After Repair Value (ARV)

Calculating the ARV of a property is quite simple, and you can do it if you have official figures from an appraiser. The formula is as follows:

Why Is ARV Important?

The After Repair Value (ARV) is most commonly used by flippers when determining whether to take on a project. It helps the flipper keep the renovations under budget so they can make a profit on their investment. Essentially, the ARV tells investors whether or not to invest in a property and, if so, the amount of profit they are likely to get.

How the ARV Works

The ARV formula remains constant except under the circumstances discussed under ‘Exceptions to the 70% Percent Rule,’ where you might have to adjust the variables. Besides the formula, using ARV requires that you establish the variables.

Limitations of ARV

The ARV has drawbacks, one of which is its inability to factor in fluctuating market values. When established, the ARV of a property takes into account its current market value, which can change over time as market conditions shift and as renovations continue.

Estimate the After Repair Value (ARV)

Estimating the ARV is a matter of reviewing comparable properties, and estimating the value after the property is repaired and ready to sell.

Get the Comps

The problem many investors have in estimating the ARV is getting the comps. So, here are five ways to get the comps, so you can estimate the ARV.

Graystone Investment Group

Graystone Investment Group is an experienced real estate wholesaler in Tampa Bay. We serve local and international clients who flip homes in as little as 30 days, as well as clients who hold high cash flowing rental properties.

How to determine the value of a property?

There are three main ways to go about determining a property’s value: Do it yourself using some online resources and some math. Use a realtor – have them supply the comps and possibly have them generate a CMA (Comparable Market Analysis) Use an appraiser.

Can a realtor get 20 CMAs a day?

Realtors won’t generate 20 CMAs a day for you no matter how good they are. And appraisers are expensive and take time, while you have to make an offer quick! So this post will focus on number one – determining value yourself. This is a skill that, in my opinion, you absolutely must learn!

What is the After Repair Value?

In simple words, after repair value, is the value of the property after it has been fixed or repaired and ready to be sold. It includes the total renovation value and the estimated selling price of the property.

How is After Repair Value (ARV) determined?

Calculating after repair value (ARV) of a property is a skill, a seasoned real estate investor may determine the value of a property they have renovated or the ones that are ready to sell.

Why is ARV Important for Real Estate Investors?

Fix-and-flip is a popular investment strategy amongst real estate investors. The after repair value (ARV) helps investors determine the maximum value they should pay for a house, the cost of repairs, and most importantly planning for their finances.

Takeaways

A real estate investor needs to determine the after repair value (ARV), as it decides if a property will be profitable enough after essential repairs and renovation or not. To determine the projected value of a property, an investor should firstly know the property’s current value.

How Do You Calculate After Repair Value

- The ARV formula itself isn't complex. The property's current value is the amount the investor purchased the house for, and the total renovation cost is the value of renovations made or an estimate.

How The After Repair Value (ARV) Works

- Establishing the variables for the equation can be tricky. A property's current value reflects its current condition. The investor must be able to pay as far under the current value of the home to maximize their profits when they sell it. Renovation estimates are the riskiest aspect of investing in a home repair. There may only be the damage that can be seen, or there might be much more …

Limitations of The After Repair Value

- The ARV is a calculation of a snapshot in time—the value of the property under the current housing market conditions and the home's state of repair at the time of calculation. This value can change daily throughout the renovation cycle of a home. The housing market can fluctuate, causing comparable home values to go up or down. Renovation costs can vary depending on th…