12 Quickest Ways to Fix Your Credit Score.

- 1. Determine Where You Stand. As with most things in life, you need to know where you stand to effectively plot your course forward. When it comes to ...

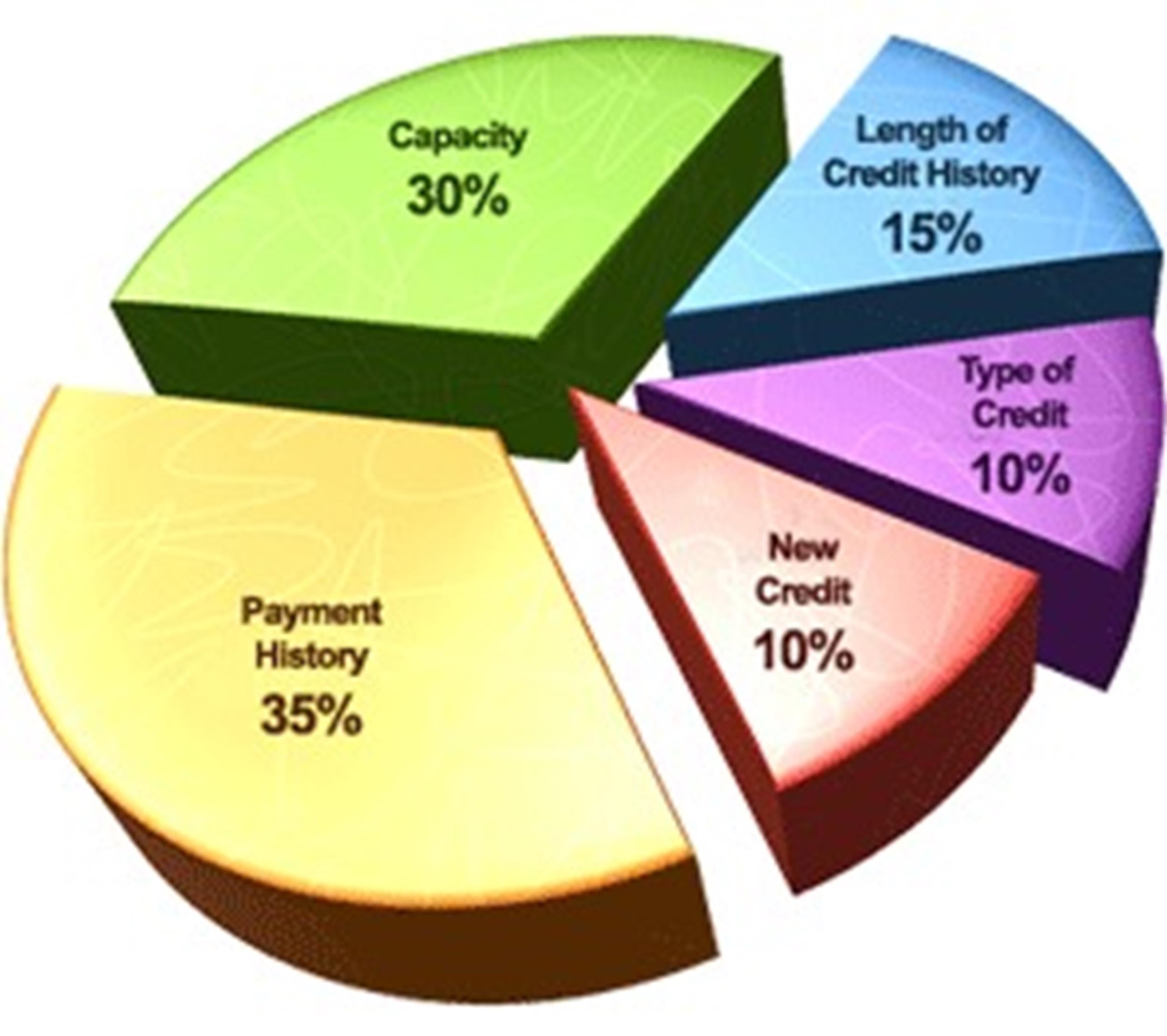

- 2. Know How Your Score is Calculated.

- 3. Fix Your Credit Report.

- 4. Pay Down Your Balances.

- 5. Negotiate with Your Creditors.

- Check Your Credit Score & Report. ...

- Fix or Dispute Any Errors. ...

- Always Pay Your Bills On Time. ...

- Keep Your Credit Utilization Ratio Below 30% ...

- Pay Down Other Debts. ...

- Keep Old Credit Cards Open. ...

- Don't Take Out Credit Unless You Need It.

How to fix your credit score in 5 steps?

improve your credit score is pay your bills by the due date. You can set up automatic payments from your bank account to help you pay on time, but be sure you have enough money in your account to avoid over-draft fees. 3. Understand how your credit score is determined. Your credit score is usually based on the answers to these questions:

How to successfully repair your credit all by yourself?

Quick Tips for Repairing Your Credit

- Lower Your Credit Utilization Ratio. Remember that credit utilization ratio we talked about earlier? ...

- Request a Credit Limit Increase on Credit Cards. ...

- Become an Authorized User. ...

- Consolidate Your Credit Card Debt. ...

- Get a Credit-Builder Loan. ...

What is the fastest way to raise credit?

Raise Your FICO® Score Instantly with Experian Boost™

- Pay All Your Bills On Time. On-time payment history is the most important factor when building credit. ...

- Get a Secured Credit Card. A secured credit card is designed to help borrowers build their credit. ...

- Become an Authorized User. ...

- Pay Off Any Existing Debt. ...

- Apply for a Credit-builder Loan. ...

- Request a Credit Limit Increase. ...

How do you boost your credit score?

How to Improve Credit Fast

- Pay credit card balances strategically. The portion of your credit limits you're using at any given time is called your credit utilization. ...

- Ask for higher credit limits. When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit.

- Become an authorized user. ...

How can I rebuild my low credit score?

7 Ways to Help Rebuild CreditReview Your Credit Report. Your credit score is affected by a number of factors. ... Pay Your Bills on Time. ... Catch Up on Overdue Bills. ... Become an Authorized User. ... Consider a Secured Credit Card. ... Keep Some of Your Credit Available. ... Stay on Top of Your Progress.

Can you fix a ruined credit score?

Paying down debt, applying for a secured card and disputing errors are all solid options to repair your credit.

What is the fastest way to rebuild bad credit?

Then consider these six basic strategies for rebuilding credit:Pay on time. Pay bills and any existing lines of credit on time if you possibly can. ... Try to keep most of your credit limit available. ... Get a secured credit card. ... Get a credit-builder loan or secured loan. ... Become an authorized user. ... Get a co-signer.

How can I wipe my credit clean?

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

Can I repair my credit myself?

There are legitimate steps you can do yourself — without having to pay a credit repair company — to repair your credit. These steps include reviewing your credit reports for errors, paying down debt and getting a credit card that reports on-time payment activity to the credit bureaus.

Can you bounce back from bad credit?

Unfortunately, there is no quick way to "repair" or "fix" your credit. The length of time it takes to rebuild your credit history depends on how serious your credit issues were and how your credit history was affected. It could take just a few months, or it could require several years of commitment.

What is the lowest credit score ever?

300In most scoring models, the lowest credit score you can have is 300. However, very few people actually have scores this low....Takeaway: The lowest possible credit score you can have is 300.Standard credit scores range from 300 to 850. ... The national average credit score in 2021 was 716 for FICO and 694 for VantageScore.More items...•

How long does it take to rebuild your credit history?

If you've had a major setback, it usually takes about one to two years to repair your credit, according to Weaver. But that depends on your individual situation. For example, FICO research shows that it takes about five to ten years to recover from bankruptcy, depending on your credit score.

First Step: Check Your Credit

The first thing you need to do is get your credit reports and credit scores from each of the credit bureaus so that you can gauge where you’re at a...

What Will I See on These Reports?

You’ll see basic details about yourself — your name, birthday, address, etc. It’s important to review these to make sure they’re accurate. Note: Pa...

You Can’T Fix Bad Credit in 30 Days

We get it — you’ve found problems. Whether they’re errors or areas you need to focus on you may find yourself wanting results quickly, however, the...

How Long Does It Take to Repair My Credit?

If you have accurate negative information on your credit reports, then it can take a while for it to age off. Here’s how long negative marks remain...

Steps to Rebuild Your Credit

Remember, your path to better credit will vary significantly depending on your credit score problems. Here’s how to rebuild it.

Why You Should Fix Your Credit

There are many reasons an individual should start on the path to credit repair. Some of the bigger reasons include the advantage of saving money on...

What to do if you are late on a credit card?

Even if you’ve been late in the past, timely payments now and into the future will help. Bring past-due accounts current. If you’ve missed a few credit card or loan payments, the account is considered past due. To bring it current, send enough to cover the missed payments and you’ll be back in good standing.

How to broaden credit card debt ratio?

You can also broaden the ratio by asking your credit card company for a higher limit, opening another credit card, or consolidating your credit card debt with a loan (keeping those now deleted accounts open and active, but not carrying over a balance). Pay collection accounts.

What happens if you miss a payment?

If you missed payments for six months or more, a lender may write the debt off, and a “charge-off” will appear. Collection accounts can show up, too, either as paid or outstanding. Public records. The courts can also send information to the credit reporting agencies, and you’ll want this section to be empty.

How many credit reporting agencies are there in the US?

There are three major credit reporting agencies in the U.S.: TransUnion, Equifax, and Experian. Although you can get copies from the companies that produce them, the easiest way is to access all three at once from annualcreditreport.com.

How much credit utilization should I have?

Credit utilization is a major factor in credit scores, and owing as little as possible, especially as compared to your credit limit, is ideal. Having 70% to 75% of the credit limit available should keep you in good credit shape. Pay down your credit cards and loans to make an instant scoring improvement.

What information should be on my credit report?

None of this data is factored into credit scores, but inaccuracies can be an indication that someone else’s accounts are showing up on your report.

Can I view my credit report?

Some don’t even view the reports but check the credit scores that are derived from the information that appears on them. To ensure that all opportunities are open to you, those numbers should be nice and high. The time is now to correct any issues that might be hurting your credit reports and scores.

How to address credit problems?

This means going through your credit reports — all three of them — line by line and determining which items can be addressed (and which can’t). You should also put together a solid budget, with designated funds for paying down debt and saving for retirement.

How do delinquent payments affect credit score?

Due to this factor, delinquent payments and defaulted accounts can drop your credit score by dozens of points. Always make your full payments by the due date to avoid detrimental credit score impacts. Of almost as much importance as how you pay your debts is how much debt you already have — and how much you could have.

How long does it take for a delinquent payment to fall off your credit report?

Thankfully, delinquent payments won’t actually haunt your credit forever, falling off your report entirely after seven years.

Why do you have to make multiple payments on a credit card?

For credit cards, which are revolving debts, making multiple payments reduces the amount of interest you’ll be charged the next month, thanks to the way credit card interest works. In essence, each payment reduces your card’s average daily balance, on which your interest fee is based.

What is the most influential factor in your credit score?

Regardless of scoring model, the most influential factor of your score is your payment history, which is more than A third (35%) of your FICO score and considered to be “extremely influential” to your VantageScore. Due to this factor, delinquent payments and defaulted accounts can drop your credit score by dozens of points.

What does each credit reporting agency collect?

Each credit reporting agency collects information about your financial behaviors from your creditors and certain public records, which collectively makes up your credit report. Creditors and scoring agencies use the information in your credit report to calculate your credit score and determine your credit risk.

What are negative marks on credit report?

Negative marks and accounts on your credit report, such as delinquent payments, defaulted debts, or bankruptcy discharges, increase your credit risk, and thus will have negative impacts on your credit score.

How your credit score is calculated

Before you can repair your credit, it's important to understand how your credit score is calculated. Data from your credit report, which contains information on any credit accounts such as credit cards, car loans, student loans and more, is used to calculate your credit score.

8 steps for fixing your credit score

If you want to increase a low credit score, the first step is to look at your credit report and review it for accuracy. Throughout the pandemic, you can access free weekly online credit reports from the three bureaus by going to AnnualCreditReport.com. You can also get up to six free credit reports through 2026 from Equifax.

How long does it take to fix your credit?

This depends on how your credit was affected and the seriousness of your credit issues. While some can fix their credit in a few months, others may find it takes a year or more to see serious improvements.

Are credit repair companies scams?

There are some legitimate credit repair companies that can help you dispute errors on your credit report. However, there's nothing these companies can do that you can't handle on your own through the credit bureau dispute process.

Will closing a credit card with poor payment history increase my score?

Closing a credit card with poor payment history will not increase your score, and it could actually lower your score temporarily. When you close a credit card, it lowers your available credit and increases your credit utilization ratio. If it was one of your first cards, it could also lower your average credit history.

What was Brittany Williams' credit score?

Nine years ago, Brittnay Williams’ credit score was 569 —putting her in the “very poor” category and undermining her dream of buying a home. But over the course of two years and with the help of her credit union, Williams, of West Memphis, Ark., raised her score by 100 points and qualified for a mortgage. When she began her journey, Williams, 32, ...

What percentage of white people have a FICO score of 700?

For example, a 2019 analysis from the Urban Institute, a nonprofit research organization, found that more than 50 percent of white people had a FICO score greater than 700, while just 21 percent of Black people did.

How long does a payment snafus stay on your credit report?

Indeed, such payment snafus can stay on your report for seven years —a period set in the 1970 Fair Credit Reporting Act. But that is “arbitrary,” says Wu at the National Consumer Law Center. She says that Sweden and Germany keep negative items on credit reports for three to four years.

Can you dispute a credit score?

Worse, consumers can’t directly dispute a credit score , though the credit report data behind scores often have errors. Around a third of the almost 6,000 volunteers for a recent CR study found mistakes in their credit report. For Williams, building credit had a lasting impact.

Can a poor credit score prevent you from renting an apartment?

And because landlords and insurers also often check credit reports, a poor score can “prevent you from renting an apartment, or mean you’ll pay more for car insurance ,” she says. Credit scores also suffer from a lack of transparency, some consumer advocates say.

Do blacks have lower credit scores than whites?

That’s particularly true for Blacks and Hispanics, who have substantially lower credit scores, on average, than whites, says Chi Chi Wu, staff attorney for the National Consumer Law Center, a nonprofit that works for consumer justice and economic security.

Does Michelle Williams pay back her credit card?

Williams paid back the loans, dramatically improving her credit score. You may be able to get a loan more easily at a credit union than at a bank, says Felicia Lyles, a senior vice president at Hope. That’s because credit unions are nonprofits, owned by their members, and often offer better terms.

How To Find Out If You Have A Bad Credit Score

Before doing anything else, you must know where you are, and what you have to work with

3 Extra Tips on How to Fix a Bad Credit Fast

If you never heard of Reddit, it is the world’s largest forum where people come together to discuss certain topics – in this case, credit repair.