- Get a Copy of Your Credit Report and Your Credit Score. Credit repair begins with a copy of your credit report. ...

- Fix Errors on Your Credit Report. Genuine credit blunders are hard to stomach, but they are real. Errors, on the other hand, need extraction.

- Build a Good Credit History and Keep Your Credit Accounts Healthy. Healthy credit accounts create healthy credit scores. ...

- Maintain a Balanced Debt-To-Credit Ratio. Got a $5,000 credit limit on that new card of yours? Don’t spend it all at once. In fact, don’t spend it all—ever.

- Review the Age of Your Credit Accounts. Older revolving or installment accounts kept in good standing look great on your credit report. ...

What if a delinquency was not removed from my credit report?

If you realize that a reported delinquency wasn’t removed when it should’ve been, you should retrieve a copy of your credit reports from the three major credit bureaus. (You can see your TransUnion and Equifax reports for free on Credit Karma .) The credit reports might not be identical,...

How can I repair my credit?

Each tip specifies a step you can take to repair your credit and keep it in good shape. 1. Always Pay Your Bills On Time Your payment history is the most significant factor that determines your credit score. As you can see, 35% of your FICO score stems from your credit history.

How long does it take for a credit card to report delinquent?

However, many creditors will not report an account as delinquent to credit bureaus until at least 30 days after the missed due date, and if you’ve previously had a clean payment history, your creditor might not report the delinquent account until after two consecutive missed payments.

How does credit card delinquency affect your credit score?

Multiple delinquencies or a longer period of delinquency can affect your credit score much more negatively. For example, your credit score could drop as much as 125 points after numerous missed payments are posted to your credit report.

Can delinquency be removed from credit report?

They cannot be removed after two years, but the further in the past the late payments occurred, the less impact they will have on credit scores and lending decisions.

How do I fix a delinquent account?

If you have an account that's currently past due, there are a few options for dealing with it.Pay the Entire Past-Due Balance. DNY59 / Getty Images. ... Catch Up. ... Negotiate a Pay for Delete. ... Consolidate the Account. ... Settle the Account. ... File for Bankruptcy. ... Seek Consumer Credit Counseling.

How long does a serious delinquency stay on your credit?

approximately seven yearsGenerally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

Will paying off delinquent debt improve my credit?

When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve. However, because older scoring models do not ignore paid collections, scores generated by these older models will not improve.

How can I wipe my credit clean?

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

Can you have a 700 credit score with late payments?

A single late payment won't wreck your credit forever—and you can even have a 700 credit score or higher with a late payment on your history. To get the best score possible, work on making timely payments in the future, lower your credit utilization, and engage in overall responsible money management.

Can you buy a house with a delinquent accounts?

Collections show on your credit report, and outstanding collections will raise concerns for lenders. Charge-offs are debts that cannot be collected and are written off by the lender. Any debt overdue (120 days for loans, 180 days for credit card debt) must be written off.

How do I recover a delinquent loan?

Step 1: Identify Delinquent Accounts. Prevention is the first step for effective delinquent account recovery. ... Step 2: Get to Know Your Borrowers. ... Step 3: Use Alternative Data to Recover Serious Delinquencies. ... Step 4: Use Repossession and Settlement Initiatives.

How do I rebuild my credit after collections?

6 steps for fixing your credit after getting a collection accountCheck the validity of your collections. ... Negotiate with debt collectors to delete the collection account. ... Pay off your collections. ... Bring all your other accounts current. ... Start adding positive information to your credit report. ... Keep your finances in order.

Can I have a 700 score with collections?

Yes, it is possible to have a credit score of at least 700 with a collections remark on your credit report, however it is not a common situation. It depends on several contributing factors such as: differences in the scoring models being used.

Should I pay a 6 year old debt?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

Can I get a loan with a delinquency?

Delinquency can also make it harder to secure approval for new loans or credit cards in the future, and if you're approved at all, you'll probably receive a higher interest rate. A delinquent bill that remains unpaid risks going into default.

How do I pay a delinquent account?

How to pay off debt in collectionsConfirm that the debt is yours. ... Check your state's statute of limitations. ... Know your debt collection rights. ... Figure out how much you can afford to pay. ... Ask to have your account deleted. ... Set up a payment plan. ... Make your payment. ... Document everything.

What happens when an account is delinquent?

When you have a delinquent account, your lender or credit card issuer might: Day 1: Charge you a late fee. Day 30: Report your account as late to the three major credit bureaus and charge you another late fee if you miss a second payment.

What to do if you are late on a credit card?

Even if you’ve been late in the past, timely payments now and into the future will help. Bring past-due accounts current. If you’ve missed a few credit card or loan payments, the account is considered past due. To bring it current, send enough to cover the missed payments and you’ll be back in good standing.

What happens after you file a dispute with a credit reporting agency?

After you file a dispute, the credit reporting agency will communicate with the furnisher (such as the lender, collection agency, or courts). The furnisher will then investigate your claim and report its findings back to the credit reporting agency.

What is trade line on credit report?

Trade lines. This is the meat of your credit report. It includes your borrowing activity and debts, such as how you’ve been managing credit cards, loans, and finance companies. You’ll see the details about your accounts, like the original balance, the date it was opened, and your monthly payment history. If you missed payments for six months or more, a lender may write the debt off, and a “charge-off” will appear. Collection accounts can show up, too, either as paid or outstanding.

What are the major credit reporting agencies?

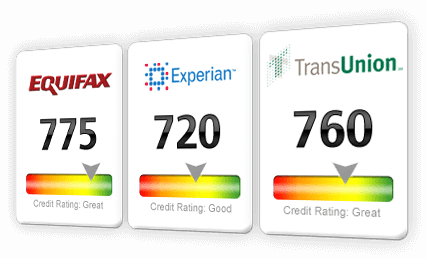

There are three major credit reporting agencies in the U.S.: TransUnion, Equifax, and Experian.

How long does it take to get a credit report?

Whichever dispute method or credit reporting agency you choose, the Fair Credit Reporting Act allows for approximately 30 to 45 days for the investigation to be completed.

How many sections are there in credit reports?

After accessing the credit reports online, print them out. As you’ll see, they are divided into four sections, so read through each and look for areas of concern:

What happens if you can't pay back taxes?

If you can’t pay what you owe immediately or in full, the IRS has a Fresh Start Program, where you may be able to enter into a payment plan or settle for less than what you owe, then have the lien lifted.

How does a credit repair company work?

Credit repair companieswork mostly by deleting negative information from your credit report, typically errors. But that’s only one tiny part of fixing your credit score. And you might be able to dispute errors yourself faster.

How long does it take for credit score to change after paying down credit card?

Sometimes it can take at least a few weeks for creditors to report your payment information and companies to update your score because of it.

What is credit utilization ratio?

Your credit utilization ratio is measured by comparing your credit card balances to your overall credit card limit. Lenders use this ratio to evaluate how well you manage your finances. A ratio of less than 30% and greater than 0% is generally considered good.

What does paying off debts do to your credit?

If you have outstanding debts, paying them off can help improve your payment history and reduce your credit utilization ratio.

How many points can you drop on your credit score?

Don’t Take Out Credit Unless You Need It. Each time you apply for credit, your creditor will run a hard credit check. This can drop your score by one to five points. It’ll also lower your average account age, which also can drop your credit score.

How many people have errors on their credit report?

According to one study by the Federal Trade Commission, a quarter of people had errors on their credit report and 5% of people had errors that could have made getting a loan more costly for them. So while knowing your credit report and credit score is a good first step, it’s also crucial to look for errors.

What is the average credit score?

Get Started. While the average credit score in the U.S. is 710, that doesn’t mean everyone has good credit. If you happen to have a poor or damaged credit score (typically below 670), it can hold you back from the things you want, whether that’s getting a new car, renting a nice apartment or buying your dream home.

How Do You Remove Serious Delinquencies From Your Credit Report on Your Own?

You can remove serious delinquencies on your own, but it's not always easy, and it takes time and effort to work through the process to make sure your results are as successful as possible.

Who Should You Contact to Dispute Debt?

If you believe you have a claim to dispute serious delinquency on your credit report or dispute other issues, you need to know who to contact and how to file a dispute. It takes time, effort, and energy, but if it is important to you, there are ways you can do this.

What to Do if You Are Unsuccessful at Disputing Delinquencies

It can be a lengthy and time-consuming process to correctly dispute the debt in an attempt to clean up your credit report. If you are uncomfortable with the process, do not have the time to write letters or file disputes, or have been unsuccessful, it can be extremely frustrating.

How to Dispute Delinquencies on Your Credit Report With DoNotPay

If you are intimidated by the dispute process, do not have the time, or have been unsuccessful thus far, you are probably frustrated and wondering if you will ever get your credit report cleaned up. If you need assistance to dispute delinquent accounts on your credit report, DoNotPay has a simple solution.

Why Should You Use DoNotPay to Dispute Delinquent Accounts?

DoNotPay has a history of being fast, easy and successful. We know your time is valuable, so we make sure you don't have to waste it by filling out online forms, making numerous phone calls, or trying to write effective negotiation letters.

DoNotPay Can Help You Repair Your Credit in Many Ways

If you are trying to raise your credit score, you know that you need to repair your credit report. You also know that this can be tedious, time-consuming, and even frustrating.

What Else Can DoNotPay Do for You?

Helping you dispute delinquencies and clean up your credit report is just one of the many things DoNotPay can do for you. For instance, we can:

When and how to remove delinquency from my credit report?

If you have a delinquent credit card debt that has not yet been charged off or sent to collections, making timely debt payments is the best way to reduce the impact of the delinquency on your credit score. Your credit report will still show that you missed a few payments, but a strong history of on-time payments can overcome a brief period of delinquency.

What to do if your credit report includes a delinquent debt?

If your credit report includes a delinquent debt that you don’t recognize, get the debt removed as quickly as possible. That way, you can maintain the credit report — and credit score — that you deserve. Editorial disclosure: All reviews are prepared by Bankrate.com staff.

How do I pay off serious delinquency?

If your credit account has been delinquent for more than 30 days, you need to prioritize making payments as quickly as possible. Many people have trouble paying off credit card debt, especially when it has started to spiral out of control — but the sooner you can start making payments, the sooner you’ll get out of delinquency and back on track.

How long does it take for a credit card to appear on your credit report?

This generally happens after three or four months of delinquency, and it may coincide with your credit card issuer deciding to cancel your credit card.

What happens if you have a credit card delinquency?

If the debt delinquency timeline continues beyond four months, your bank or credit card issuer may close or cancel your credit account. This means you will no longer be able to use your credit card to make purchases — but you’ll still be responsible for paying off your unpaid debt.

How long does a derogatory mark stay on your credit report?

If your debt has been delinquent for so long that it has become derogatory, you can expect that derogatory mark to remain on your credit report for seven years.

How long does it take for a credit card to report a late payment?

Most credit card companies do not report a delinquent credit account to the credit bureaus until your payment is over 30 days late — so if you catch your delinquent credit card bill in time and make a payment, your overdue bill won’t have a negative effect on your credit score.

How to keep credit under control?

Stick to a budget: To keep your credit under control, you’ll need to spend according to a plan that doesn’t rely on debt. Your monthly budget should reflect your priorities and include only items you can afford. You may have to find ways to increase your income or cut expenses if you’re serious about controlling your debt.

How long does it take for a credit report to drop?

The credit agencies drop inquiries from your credit reports after two years. New credit accounts for only 10% of your FICO score, so unless you are in full credit repair mode, you shouldn’t let it stop you from applying for new credit when you need it.

What does FICO measure?

FICO rewards you for keeping your unsecured debt levels under control. FICO measures your credit card debt using the credit utilization ratio metric (CUR, also known as the debt-to-credit ratio ).

What is a Cur?

CUR specifically relates to unsecured credit cards — the calculation excludes other forms of debt, including home equity revolving accounts. CUR will also ignore your secured credit card (if you have one).

What is the best credit score?

FICO and VantageScore are the most widely used credit scoring models and both range from 300 (worst) to 850 (best).

How many points does FICO take off your credit?

It is afraid that you may be on the slippery slope to financial desperation. Overblown? Perhaps. But FICO will shave five to eight points from your credit score for every hard pull. The damage dissipates after one year.

How much of your FICO score is from your credit?

As you can see, 35% of your FICO score stems from your credit history. Paying your bills on time is mandatory if you’re serious about repairing your credit.

How long does it take for a credit card to report a delinquent payment?

But many creditors won’t report an account as delinquent to credit bureaus until at least 30 days after the missed due date. And if you’ve previously had a clean payment history, your creditor might not report the delinquent account until after two consecutive missed payments.

How do I remove a delinquent account from my report?

As previously stated, delinquent accounts are typically removed seven years after the date of the original delinquency. Even if the debt is sold to a collection agency, the original date of delinquency is normally when you defaulted on the original creditor. Unfortunately, these accounts don’t always disappear on schedule, so you may have to put in a little extra work to take them off.

What if dirty dishes symbolized late credit card payments?

Dirty dishes might seem irrelevant to your credit reports, but what if the dirty dishes symbolized late credit card payments? Imagine that you’re the annoying roommate to your creditors, who are becoming increasingly frustrated with your delinquency. They might tolerate one late payment and give you a second chance. But if you keep making mistakes, you can ruin your relationship with them, in addition to maiming your credit scores.

How late can you report a debt?

Additionally, there are multiple levels of delinquency that may be reported on your credit reports. A debt can be reported as 30, 60, 90 and then 120 days late. Multiple delinquencies or a longer period of delinquency can affect your credit scores much more negatively.

How long does missed payment stay on credit report?

Also, even after you’ve fully paid off these debts, the missed payment information on your credit reports may still remain for up to seven years, signaling potential irresponsibility to future creditors. So it’s usually in your best interest to fulfill at least the minimum payment due each month, and, if you do end up with delinquent accounts, to eventually pay those off, especially if they’ve gone into collections.

Can you dispute a delinquency on your credit report?

The credit reports might not be identical, so it’s a good idea to know if the delinquency hasn’t fallen off one or all of them. If you believe a credit bureau has included a delinquency that is inaccurate or outdated, you can file a dispute with the credit bureau.

Is there anything more annoying than a roommate who leaves their dirty dishes in the sink?

Then they forget again and a few more dishes are added to the sink. By this point, you’re frustrated, but not as angry as when they then do it a third consecutive time. Ultimately, you move out and tell all of your friends what a horrible roommate they were, and your old roommate’s reputation is ruined.

What to do if credit bureau says inaccurate information?

Ask the credit bureau to remove or correct the inaccurate or incomplete information.

How to correct a mistake in your credit report?

How To Correct Mistakes in Your Credit Report. Both the credit bureau and the business that supplied the information to a credit bureau have to correct information that’s wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported ...

What to do if your business keeps disputed information?

If the business keeps reporting disputed information, check that the credit bureaus placed a notice that you are disputing that information.

What happens if a business keeps reporting a dispute to the credit bureau?

If the business keeps reporting the disputed information to a credit bureau, it must let the credit bureau know about your dispute and the credit bureau must include a notice that you are disputing it as inaccurate or incomplete. If the business finds the information you dispute to be inaccurate or incomplete, the business must tell ...

What happens if a business reports inaccurate information to the credit bureau?

If the business finds the information they reported is inaccurate, it must notify all three nationwide credit bureaus so they can correct the information in your file.

What happens if a credit bureau considers your credit request to be frivolous?

If the credit bureau considers your request to be “frivolous” or “irrelevant,” they will stop investigating, but they need to notify you of that and give the reason. For instance, you may need to give them additional evidence to support your request.

What does credit bureau sell?

Credit bureaus sell the information in your report to businesses that use it to decide whether to loan you money, give you credit, offer you insurance, or rent you a home. Some employers use credit reports in hiring decisions. The strength of your credit history also affects how much you will have to pay to borrow money.