It’s because there are only three simple things to do to repair bad credit:

- Pay all of your bills on time

- Pay down debt (especially credit card debt)

- Avoid applying for credit

- Check your credit reports for errors. ...

- Pay down any credit card debt you have. ...

- Get a credit card if you don't have one. ...

- Consider signing up for Experian Boost. ...

- Wait for negative items to fall off your credit reports. ...

- Apply for new credit sparingly. ...

- Pay your bills on time, every time.

What is the best way to start repairing my credit?

How to Repair Credit in 5 Fast Steps

- Assess the Damage and What Needs Repairing. You can’t know what’s hurting your credit without reading over your most recent credit reports, so you want to pull them ...

- Begin the Dispute Process. As per the Fair Credit Reporting Act, consumer credit reports must only contain accurate and timely information.

- Halt Further Credit Report Damage. ...

How to successfully repair your credit all by yourself?

Quick Tips for Repairing Your Credit

- Lower Your Credit Utilization Ratio. Remember that credit utilization ratio we talked about earlier? ...

- Request a Credit Limit Increase on Credit Cards. ...

- Become an Authorized User. ...

- Consolidate Your Credit Card Debt. ...

- Get a Credit-Builder Loan. ...

How to fix credit in 8 Easy Steps?

More specifically, the CROA regulates these companies in the following ways:

- Prevents repair services from making outlandish claims—for example, that they can improve credit scores even when their clients do not have any inaccuracies in their reports.

- Requires repair companies to state their fees up front.

- Prohibits repair companies from misleading customers into thinking they could not complete the services themselves.

How fast can my credit be repaired?

Lexington Law

- Free consultation: 1-855-200-2394

- Most results of any credit repair law firm

- Clients saw over 9 million negative items removed from their credit reports in 2016

- More than 500,000 credit repair clients helped since 2004

- Cancel anytime

- Click here for sign-up, terms, and details.

What is the fastest way to repair your credit?

Here are some strategies to quickly improve your credit:Pay credit card balances strategically.Ask for higher credit limits.Become an authorized user.Pay bills on time.Dispute credit report errors.Deal with collections accounts.Use a secured credit card.Get credit for rent and utility payments.More items...

How can I fix my bad credit?

How to Improve a Bad Credit ScoreCheck Your Free Credit Score. First, check your credit score for free to view the factors that are most affecting it. ... Pay Your Bills on Time. ... Pay Down Debt. ... Avoid New Hard Inquiries. ... Boost Your Credit. ... Get Help Building Credit.

How can I wipe my credit clean?

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

Can I pay someone to fix my credit?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

Can you erase bad credit history?

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

Can I pay to clear my credit history?

Whether your attempts to pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. “As to the debt collector, you can ask them to pay for delete,” says McClelland. “This is completely legal under the FCRA.

How do I get a collection removed?

You can ask the current creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Can you cheat your credit score?

You Cannot Cheat Your Credit Score Without Committing Fraud, But You Can Legitimately Boost it Quickly. The way the FICO scoring system has been designed prevents people from artificially manipulating their credit score – at least for very long.

What Is The Credit Repair Organizations Act?

The Credit Repair Organizations Act is a federal law that became effective on April 1, 1997 in response to a number of consumers who had suffered f...

How to “Fix” Your Credit by Yourself

There is no quick fix for your credit. Information that is negative but accurate (such as late payments and delinquencies) will remain on your cred...

More Options For Credit Repair

If your debt feels overwhelming, it may be valuable to seek out the services of a reputable credit counseling service. Many are non-profit and char...

What is credit repair software?

Credit repair software still lets you take control of your DIY credit repair, but offers extra help in the form of step-by-step guidance and formatted templates for you to use.

How to remove a credit report if it is erroneous?

If the agency finds that the entry is erroneous, they must remove it from the report. Writing a letter to the credit reporting agency or agencies that have listed the erroneous entries on your report is the easiest way to get them removed.

How to dispute a negative credit report?

Dispute Negative Items by Writing Letters to the Bureaus 1 A separate dispute letter is required for each erroneous entry you are disputing. 2 Attach a recent copy of your credit report with the erroneous entry highlighted and with the front page included. 3 Keep your dispute letter clear and simple. State only the relevant facts, and explain the reason for disputing the entry. 4 Be sure to include copies of any relevant documents supporting your claim. 5 If you know who the furnisher of the disputed information is, send them an identical letter at the same time. 6 Keep copies of all your correspondence with the reporting agencies, along with dates sent.

What is a credit detailer?

Functionally the same as the much more expensive Professional Edition, the Credit Detailer for home users is a powerful credit repair tool. It contains information on credit repair regulations and consumer rights, and is designed for both effective credit repair and educational opportunity. Simple, automated and customizable, Credit Detailer is worth checking out.

How to remove negative entries from credit report?

Negative entries on your credit report that are either erroneous or inaccurate can often be removed by simply writing a letter to the reporting agency. In fact, the Fair Credit Reporting Act (FCRA) states that the credit reporting agencies must investigate any disputed entry a consumer discovers on their credit report.

How long does it take for a credit report to be disputed?

The reporting agencies must respond within 30 days to letters sent to them disputing credit report entries — it’s the law! They must complete their investigation into whether this disputed entry should remain on your report within that same 30-day period.

Do it yourself credit repair?

Do-it-yourself credit repair may sound like a lot of work. And it can be — but putting in the time and effort to see your credit score improve is worth it. Living with bad credit isn’t just a nuisance; it can impact every area of your life. If you’ve finally decided to take matters into your own hands and fix your credit problems, ...

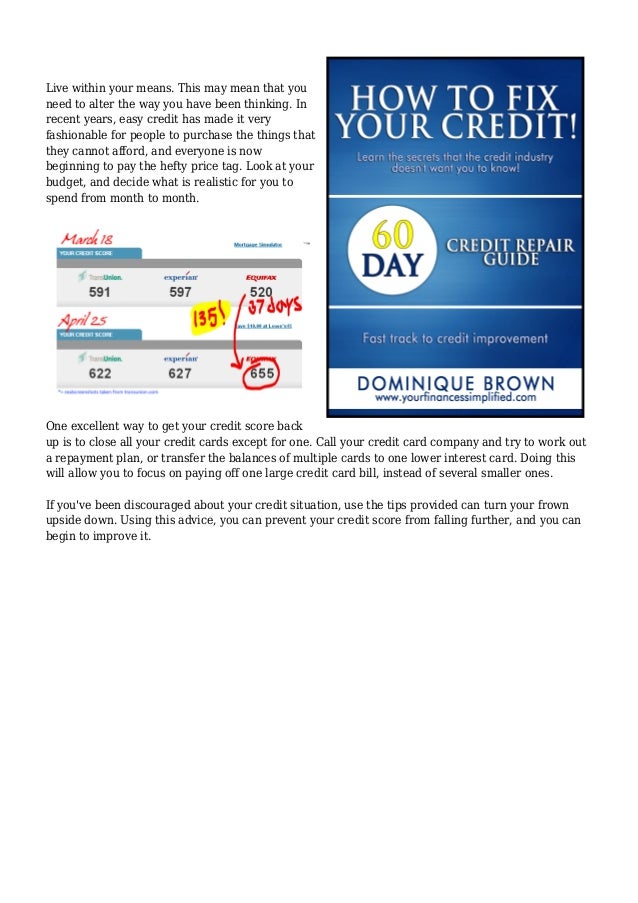

What are the major credit bureaus?

There are three major credit bureaus in the US--Experian, Equifax, and TransUnion- -and each one has a file on you. Chances are much of their information is pretty similar, but it's entirely possible that mistakes at one or more agencies are painting an inaccurate picture of your creditworthiness.

Can you fix your credit score in a week?

In most cases, you didn't destroy your credit in a week, so don't think that it will get fixed any faster. Patience is an important part of getting your FICO score back up, as is being smart about what debt you tackle in what order. Things like mortgages and student loans are generally low-interest payments you'll be making every month for a long time, so it's less important that you pay them off early, at least in the context of FICO scores.

What to do if you are late on a credit card?

Even if you’ve been late in the past, timely payments now and into the future will help. Bring past-due accounts current. If you’ve missed a few credit card or loan payments, the account is considered past due. To bring it current, send enough to cover the missed payments and you’ll be back in good standing.

How to broaden credit card debt ratio?

You can also broaden the ratio by asking your credit card company for a higher limit, opening another credit card, or consolidating your credit card debt with a loan (keeping those now deleted accounts open and active, but not carrying over a balance). Pay collection accounts.

What happens if you miss a payment?

If you missed payments for six months or more, a lender may write the debt off, and a “charge-off” will appear. Collection accounts can show up, too, either as paid or outstanding. Public records. The courts can also send information to the credit reporting agencies, and you’ll want this section to be empty.

How many credit reporting agencies are there in the US?

There are three major credit reporting agencies in the U.S.: TransUnion, Equifax, and Experian. Although you can get copies from the companies that produce them, the easiest way is to access all three at once from annualcreditreport.com.

How much credit utilization should I have?

Credit utilization is a major factor in credit scores, and owing as little as possible, especially as compared to your credit limit, is ideal. Having 70% to 75% of the credit limit available should keep you in good credit shape. Pay down your credit cards and loans to make an instant scoring improvement.

What happens if you can't pay your taxes?

If you can’t pay what you owe immediately or in full, the IRS has a Fresh Start Program, where you may be able to enter into a payment plan or settle for less than what you owe, then have the lien lifted. Treating debt and credit products responsibly will make a big difference in your credit rating, too: Pay on time.

What information should be on my credit report?

None of this data is factored into credit scores, but inaccuracies can be an indication that someone else’s accounts are showing up on your report.