How to profit with a credit repair business in Florida?

How to Profit with a Credit Repair Business in Florida. 1 1. Start. Get a powerful CRM that handles your business for you. Train and learn about the business. Create a professional website. Market your ... 2 2. Run. 3 3. Grow.

Does Florida require a credit repair license?

Does Florida require a credit repair license? We are not aware of any “state” license requirements specifically for credit repair; however depending on your city and county you may be required to obtain a local tax receipt, permit or local professional license.

What are the laws for credit repair businesses?

Before getting into the credit repair business, one of the first laws you need to become familiar with is the Credit Repair Organizations Act (CROA) . This is a federal law passed back in 1996 that states that credit repair companies need to advertise and work honestly with clients.

What is a credit repair company?

Federal and State governments call credit repair companies “Credit Service Organizations”. The acronym “C.S.O.” is an abbreviation for the term. Some states require CSO’s to register with one or more of the specific state agencies to know exactly who is practicing credit repair within their state.

Do you need a license to start a credit repair business in Florida?

In general, all states require any credit repair business to apply for an occupational license, which is regulated by the Department of Business and Professional Regulation (DBPR) in Florida. You will also be required to get a surety bond with a bonding agency.

How much can I make starting a credit repair business?

$10,000 to $20,000 per monthLearn to repair credit for yourself and others and start your own profitable business from home. Credit Repair Professionals are always in demand and can earn $10,000 to $20,000 per month (or more). Some make millions of dollars a year and truly change lives.

How do I start a credit repair company?

Start a Credit Repair Agency by following these 10 steps:Plan your Credit Repair Agency.Form your Credit Repair Agency into a Legal Entity.Register your Credit Repair Agency for Taxes.Open a Business Bank Account & Credit Card.Set up Accounting for your Credit Repair Agency.More items...•

How much does credit repair cost in Florida?

How much do bonds cost? Surety bonds typically cost between 1% and 10% of the face value based on the owner's personal credit. For example: If the face value of the bond is $10,000; it may cost as low as $100 per year or as high as $1,000 per year.

How much should I charge for credit repair?

Credit repair doesn't cost anything if you handle the process yourself. If you hire a credit repair company to assist you, you'll typically pay fees of $19 to $149 per month. There is nothing a credit repair company can do for you that you can't do for yourself.

Do you need a degree to start a credit repair business?

Education and Certification. Choose an appropriate major. While there aren't necessarily any specific education requirements for a credit repair specialist, most people working in the industry have at least a bachelor's degree in a finance-related discipline.

Can you start your own credit bureau?

Consumers invisible to banks thanks to America's enigmatic credit-reporting system have a new tool at their disposal: Experian, one of the big three credit bureaus, is introducing a new program that will allow consumers to simply create their own credit reports from scratch, the Wall Street Journal reports.

How big is the credit repair industry?

1. The US credit repair market size is worth $3.4bn in 2021. The industry has registered a revenue decline of 5.2% per year on average between 2016 and 2021. The industry is countercyclical, meaning that it generally sees a downturn when the overall economy is booming and consumers are more confident.

What type of surety bond do I need for credit repair?

California Credit Services Organization BondThe California Credit Services Organization Bond is required by the California Secretary of State under the California Credit Services Act of 1984. The required bond amount is $100,000.

How much does it cost to become a credit repair specialist?

$197 $167 today! (Includes Board Certified Credit Consultant And Certified Credit Score Consultant Credentials fees, Training materials, and membership. You will learn all about FICO and become a specialist. 12 months Membership to our trade association included.

Can I pay someone to fix my credit score?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

Are credit repair services legit?

Credit repair companies offer to help you repair your credit score for a fee—typically about $100 a month. Many of these companies provide legitimate credit repair services, but unfortunately, many more are essentially a scam.

How to start a credit repair business in Florida?

To start a credit repair company in Florida, you need to apply for an occupational license. This license is under the regulations of the state’s Department of Business and Professional Regulation (DBPR). Remember that many of your clients are new to credit repair services.

Why is Florida a good place to start a credit repair business?

Florida is a fantastic place to start your credit repair organization because it offers robust opportunities that you can explore.

How long does it take to get a response from a surety bond?

Usually, you will get a response within 24 hours to know whether the application was turned down or approved. Nevertheless, your application will be approved in most cases. Some organizations will consider your credit rating, while some will not. Note that the surety bond is not free.

What are the two federal laws that regulate credit repair organizations?

The two federal laws regulating credit repair organizations in the US are the CROA and the FCRA. Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA) specify the conditions and guidelines for your operations. The takeaway points of these regulations are:

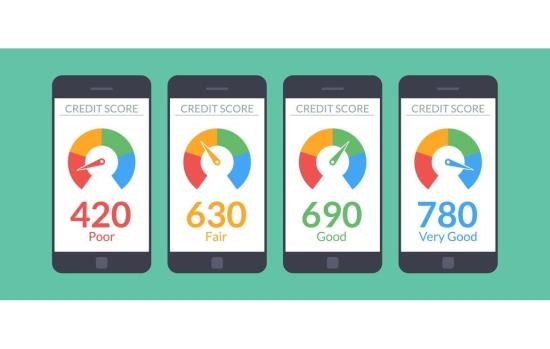

How many people have less than 600 credit ratings in Florida?

According to ValuePeguin, more than 1 million people in Florida have less than 600 credit ratings. Hence, the state is full of people who require the services of credit repair companies. Helping people resolve credit issues is satisfying, exciting, and lucrative.

Why do people feel stuck on their credit report?

They feel stuck and unable to make progress because they have not been paying attention to their credit report. Therefore, credit repair services organizations that can effectively navigate credit reports will be an instant hit in Florida. You should not be worried about finding clients but being able to meet needs.

How much does Florida make on credit report?

According to the report by WalletHub, credit report companies in Florida are making more than $3 billion per year. The state has one of the highest credit debts in the US. Florida’s credit debt was a staggering $66.4 billion in the second quarter of 2019!

How much does a credit repair business make in Florida?

The industry itself is growing. Credit repair businesses are making upwards of $3 billion a year and this is your opportunity to take a piece of that market.

What is the purpose of the Credit Repair Organizations Act of 1996?

On September 1996, the Credit Repair Organizations Act (CROA) was passed in the state to regulate organizations whose purpose is to increase a consumer’s credit score through credit repair.

What is chargebacks in business?

Record Keeping. Chargebacks are a real challenge for any high risk merchant account business. The industry is closely monitored by financial institutions. If you reach a certain level of chargebacks, it could affectively end your means of collecting payment and destroy your business.

What is CRM software?

CRM Software. This is a tip for anyone starting a business, not just credit repair. Your customer relationship management software is going to change your long term or short term success. A good CRMS will foster loyalty by means of strengthening your relationship with current clients.

Which state has the highest credit card debt?

Florida has one of the highest credit card debts in the United States. In the second quarter of 2019, the state’s credit card debt has reached a staggering $66.4 billion, according to a recent report by WalletHub. It’s the third highest increase since the first quarter of any state in the country, which means that Floridians really need help in ...

Is credit repair regulated in Florida?

Before you even think of starting a credit repair business in Florida, you need to familiarize yourself with the credit laws in Florida. The credit repair industry is heavily regulated.

What Do Credit Repair Businesses Do?

A credit repair company is a service that helps people fix their credit reports. They will do all the heavy lifting for their clients of filtering through their credit reports, identifying the issues, and then contacting the bureaus or creditors to file disputes and investigations.

Why Start A Credit Repair Business?

One big benefit of running a credit repair business is that it’s a job that can be done from your home. You need little more than a telephone, laptop, and printer to actively work with clients.

Laws And Licenses

Before getting into the credit repair business, one of the first laws you need to become familiar with is the Credit Repair Organizations Act (CROA) . This is a federal law passed back in 1996 that states that credit repair companies need to advertise and work honestly with clients.

What Are The Start-Up Costs For A Credit Repair Business?

Other than the administrative costs of having a computer, phone, and Internet connection, three of the biggest costs of opening a credit repair business will be the following:

Working With Credit Repair Clients

Once your business is established, the process of working with clients will go like this:

How To Market Your Credit Repair Business

As a work from home business, there are several ways you can promote your credit repair business:

Final Thoughts: How To Start A Credit Repair Business

Starting your own credit repair business takes a lot of knowledge and hard work, but it can be done! You now know how to start a credit repair business. From start up costs, to marketing, and more, there’s a lot to be accomplished. Use this guide and these steps to get your business up and running and help others repair their credit!

What are the laws for credit repair companies in Florida?

The Credit Repair Organization Act regulates the credit repair industry to protect consumers from dishonest credit repair companies. This will prevent credit repair companies from taking advantage of their consumers.

Who is the authority for credit repair in Florida?

The authority for credit repair in the state is the Florida Department of State.

How long does it take to cancel a credit repair contract in Florida?

The state of Florida has specific contract requirements. These include allowing consumers to cancel the contract any time within five business days after signing the contract. Furthermore, consumers must be allowed by CSOs to have a full refund within ten days from the time of signing the contract as mandated by the state. ...

Does Florida require surety bonds?

The state of Florida requires credit organizations to comply with the legislation, including the need for surety bonds. A surety bond ensures that the state, the surety bond company, and the credit repair company are bound.Credit repair companies can buy the bond from a surety company as it is required by the state of Florida.

Does Florida require credit repair companies to register?

While some states need CSOs to register with one or more specific state agencies, the state of Florida doesn’t require credit repair companies to have a CSO registration.

10. Start a collection and debt portfolios management business

Examples of a successful collection and debt portfolios management business:

Did you know that brands using Klaviyo average a 95x ROI?

Email, SMS, and more — Klaviyo brings your marketing all together, fueling growth without burning through time and resources.