Requirements to Start a Credit-Repair Business in Texas

- Services. According to the Texas secretary of state website, credit service organizations are governed by Chapter 393 of the Finance Code and the rules in the Texas Administrative Code Chapter ...

- Registration Required. The Finance Code requires that an applicant fill out a registration form (Number 2801) and provide proof of security.

- Qualifications. Individuals or companies wanting to start a CSO in Texas are free to do so, pending approval by the secretary of state and purchase of security monies.

- Startup Costs. The fee for a certificate of registration is $100, which should be made out to the Texas secretary of state.

- Security Deposits. When its consumers will pay in advance or be charged in advance, a CSO must provide a $10,000 surety bond for each location it operates.

How to start a profitable credit repair business?

If you want to start a profitable credit repair business, you need to understand the industry rules and regulations to ensure compliance. Just like any other industry, there are both Federal and State laws and every state is different.

Does Texas require a credit repair license?

Does Texas require a credit repair license? We are not aware of any “state” license requirements specifically for credit repair; however depending on your city and county you may be required to obtain a local tax receipt, permit or local professional license.

What is a credit repair company?

Federal and State governments call credit repair companies “Credit Service Organizations”. The acronym “C.S.O.” is an abbreviation for the term. Some states require CSO’s to register with one or more of the specific state agencies to know exactly who is practicing credit repair within their state.

How much does it cost to build a credit repair website?

Here is a good source I’ve recently found: www.creditrepairtemplates.com to get a website for $150.00 down and $19.99 per month for 12 months and $10 per month after a year. They are a website wholesaler and do amazing work. You can connect these sites to any software program. Again, I do not earn anything by sharing this information.

Do you need a license to fix credit in Texas?

Credit Repair Licensing in Texas A credit repair license in the state of Texas is not required; however, there may be county or city laws that would require you to obtain a local tax receipt, local professional license, or permit.

Is credit repair a good business to start?

It's a recurring-revenue business that you can launch with just a computer and a desire to change lives. Learn to repair credit for yourself and others and start your own profitable business from home. Credit Repair Professionals are always in demand and can earn $10,000 to $20,000 per month (or more).

How do I start a credit repair company?

Start a Credit Repair Agency by following these 10 steps:Plan your Credit Repair Agency.Form your Credit Repair Agency into a Legal Entity.Register your Credit Repair Agency for Taxes.Open a Business Bank Account & Credit Card.Set up Accounting for your Credit Repair Agency.More items...•

How much should I charge for credit repair?

Credit repair doesn't cost anything if you handle the process yourself. If you hire a credit repair company to assist you, you'll typically pay fees of $19 to $149 per month. There is nothing a credit repair company can do for you that you can't do for yourself.

Can you charge upfront fees for credit repair?

No credit repair organization may charge or receive any money or other valuable consideration for the performance of any service which the credit repair organization has agreed to perform for any consumer before such service is fully performed. In other words, UP FRONT CREDIT REPAIR FEES ARE ILLEGAL!

How big is the credit repair industry?

1. The US credit repair market size is worth $3.4bn in 2021. The industry has registered a revenue decline of 5.2% per year on average between 2016 and 2021. The industry is countercyclical, meaning that it generally sees a downturn when the overall economy is booming and consumers are more confident.

Can you start your own credit bureau?

Consumers invisible to banks thanks to America's enigmatic credit-reporting system have a new tool at their disposal: Experian, one of the big three credit bureaus, is introducing a new program that will allow consumers to simply create their own credit reports from scratch, the Wall Street Journal reports.

What type of surety bond do I need for credit repair?

California Credit Services Organization BondThe California Credit Services Organization Bond is required by the California Secretary of State under the California Credit Services Act of 1984. The required bond amount is $100,000.

What do credit repair companies do?

Credit repair is when a third party, often called a credit repair organization or credit services organization, attempts to get information removed from your credit reports in exchange for payment. These companies are for-profit and their services are marketed as being able to help people improve their credit.

How much does it cost to become a credit repair specialist?

$197 $167 today! (Includes Board Certified Credit Consultant And Certified Credit Score Consultant Credentials fees, Training materials, and membership. You will learn all about FICO and become a specialist. 12 months Membership to our trade association included.

How do I become FICO certified?

In order to receive this certification, candidates must agree to a code of ethics and successfully complete three one-hour online courses delivered by AllRegs Academy: Exploring FICO Scores, Analyzing the Credit Report, and Communicating Credit Information.

Can I pay someone to fix my credit score?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

How long does it take to get approved for credit repair in Texas?

The good news is that the process for its approval is seamless. You can get your approval after applying within 24 hours. Running a credit repair business in Texas can potentially earn you around $20,000 monthly. Besides, you can even receive much more with the proper strategy and excellent scaling.

What is the law for credit repair in Texas?

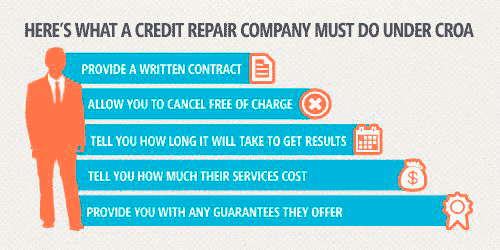

The federal laws regulating credit repair activities in the US are the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA).

How long do you have to cancel a credit card contract?

Customers have the right to cancel the contract after three days, according to the CROA. The FCRA limits the people that can view your credit report. Note that state laws can invalidate none of the directives of the federal laws. Therefore, you need to be aware of the regulations of federal and state laws.

Why do you need a surety bond in Texas?

This is according to the directives of the Texas Finance Code. The surety bond is to ensure transparency and honesty in credit repair companies’ activities. If you have a bad credit rating, some organizations may turn down your request. However, you can always find those that have alternative programs and consider you.

Which state has the lowest credit rating?

The market potential for credit repair companies in Texas is mouthwatering. According to stats from Experian, Texas, Georgia, Mississippi, Louisiana, and Nevada had the lowest average credit ratings in the US in 2019.

Do you have to pay a $10,000 bond in Texas?

However, it could have been lesser if you do not need to obtain the required $10,000 bond. You will have to pay a percentage of the total obligation, which is $1,000. Some states do not require you to obtain this bond, but it is not so in Texas.

What Budget Does It Require?

Like any startup, your business will need some capital — on average, $1,200. You need to invest to earn more in the long run. Fortunately, this niche is a genuine route to financial independence. The initial investment will return in its due time, and the profit potential is very impressive.

What Laws Will Apply?

The local industry is regulated by laws on the state and federal levels. The latter include the Credit Repair Organizations Act (CROA) and The Fair Credit Reporting Act (FCRA). Both protect citizens from exploitation by score fixers.

Bond: Why You Need It

Posting a surety bond is a requirement for licensing under the Texas Finance Code. This guarantees honesty and transparency of the subsequent operations. On the downside, if your credit rating is far from perfect, some entities may reject your requests. If this happens, look for alternatives.

Learn About the Licensing and Limitations

This statute of limitations regulates all debts within the state of Texas. It determines how much time a lender has to sue its client for payment. In the case of credit cards and debit, this may be done within seven years. This means you may only help the residents clean their reports within this period. Afterward, the issues vanish on their own.

The Bottom Line

Starting a credit repair business in Texas is a lucrative opportunity. The initial investment is relatively modest, but the potential for high revenues is undeniable. If you are determined to begin, understand that this niche is highly competitive, so standing out from the crowd will be crucial.

What is the Texas Administrative Code for credit service organizations?

According to the Texas secretary of state website, credit service organizations are governed by Chapter 393 of the Finance Code and the rules in the Texas Administrative Code Chapter 74.

How much does it cost to get a certificate of registration in Texas?

The fee for a certificate of registration is $100, which should be made out to the Texas secretary of state. If the CSO has multiple locations, a fee of $15 will be charged for each additional location.

Do banks have to register with the Secretary of State?

Banks, savings associations, credit unions, nonprofit organizations, licensed attorneys, mortgage brokers and real estate brokers are exempt from this requirement and are not obliged to register with the secretary of state.