How much should credit repair cost your clients?

- the scope of work the attorney performs

- the type and amount of debt you have, and

- how difficult it will be to settle the debt.

How much does it cost to clean up your credit?

#1 Lexington Law

- More than 500,000 clients helped

- More than 10,000,000 negative items removed in 2017

- Fraud alert and identity theft protection included

How to successfully repair your credit all by yourself?

Quick Tips for Repairing Your Credit

- Lower Your Credit Utilization Ratio. Remember that credit utilization ratio we talked about earlier? ...

- Request a Credit Limit Increase on Credit Cards. ...

- Become an Authorized User. ...

- Consolidate Your Credit Card Debt. ...

- Get a Credit-Builder Loan. ...

What is the best credit repair?

Treating debt and credit products responsibly will make a big difference in your credit rating, too:

- Pay on time. Since payment history is the most significant credit scoring factor, you can make a huge difference in your score by meeting your due dates every month. ...

- Bring past-due accounts current. ...

- Don’t accrue more debt. ...

- Apply for new credit prudently. ...

- Maintain older accounts. ...

How do credit repair companies charge?

How much does credit repair cost? You pay a monthly fee to the credit repair service, typically from $69 to $149, and the process may take several months to a year. You may pay a setup fee to begin, as well.

Can you charge upfront fees for credit repair?

No credit repair organization may charge or receive any money or other valuable consideration for the performance of any service which the credit repair organization has agreed to perform for any consumer before such service is fully performed. In other words, UP FRONT CREDIT REPAIR FEES ARE ILLEGAL!

How much can I make doing credit repair?

Credit Repair Professionals are always in demand and can earn $10,000 to $20,000 per month (or more). Some make millions of dollars a year and truly change lives. The most successful credit repair businesses all follow the very same methods and this book breaks it down into easy to follow steps.

How much does it cost to dispute credit report?

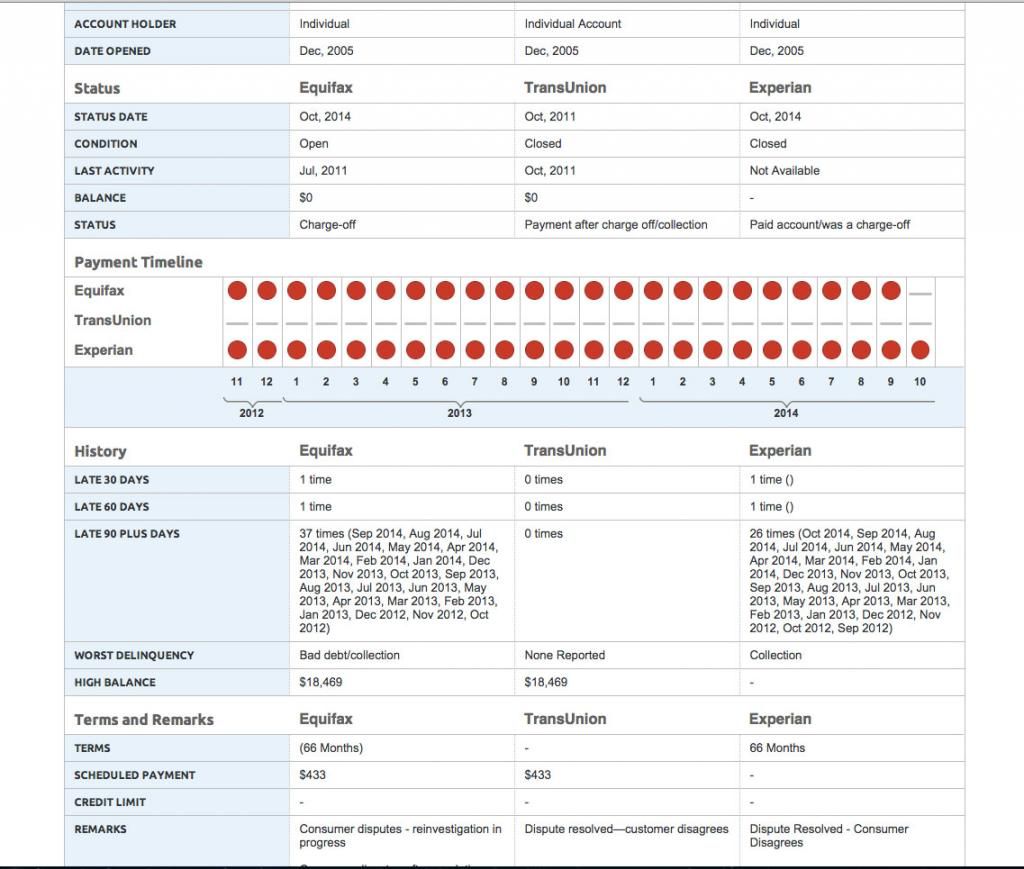

But if negative information has popped up on one report, it's wise to see whether it's also on the other two. There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Are credit sweeps legal?

Credit sweeps are a heavily advertised and promoted service among credit repair companies. Unfortunately for many unsuspecting consumers looking to improve their credit, the credit sweep is a fraudulent and illegal practice.

Can a credit repair company remove debt?

In short, no one can legally remove accurate and timely negative information from a credit report, and everything a credit repair clinic can do for you legally, you can do for yourself at little or no cost.

Do credit repair agents make money?

While ZipRecruiter is seeing salaries as high as $79,189 and as low as $19,302, the majority of Credit Repair Agent salaries currently range between $27,221 (25th percentile) to $50,978 (75th percentile) with top earners (90th percentile) making $57,907 annually in California.

How do I write a credit repair business plan?

Executive SummaryGive a brief overview of the credit repair industry.Discuss the type of credit repair business you are operating.Detail your direct competitors. Give an overview of your target customers.Provide a snapshot of your marketing strategy. ... Offer an overview of your financial plan.

How big is the credit repair industry?

1. The US credit repair market size is worth $3.4bn in 2021. The industry has registered a revenue decline of 5.2% per year on average between 2016 and 2021. The industry is countercyclical, meaning that it generally sees a downturn when the overall economy is booming and consumers are more confident.

How can I wipe my credit clean?

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

How long does it take for credit repair?

In general, credit repair takes about three to six months to resolve all of the disputes that the average consumer needs to make. Of course, if you only have a few mistakes to correct or you repair your credit every year, it may not take as long; you might be done in just over one month.

What is a 609 dispute letter?

A 609 dispute letter is a letter sent to the bureaus requesting this information is actually not a dispute but is simply a way of requesting that the credit bureaus provide you with certain documentation that substantiates the authenticity of the bureaus' reporting.

Are credit repair services legit?

Credit repair companies offer to help you repair your credit score for a fee—typically about $100 a month. Many of these companies provide legitimate credit repair services, but unfortunately, many more are essentially a scam.

How long does it take for credit repair?

In general, credit repair takes about three to six months to resolve all of the disputes that the average consumer needs to make. Of course, if you only have a few mistakes to correct or you repair your credit every year, it may not take as long; you might be done in just over one month.

Do you need a license to do credit repair in Texas?

Credit Repair Licensing in Texas A credit repair license in the state of Texas is not required; however, there may be county or city laws that would require you to obtain a local tax receipt, local professional license, or permit.

Is CreditRepair com legit?

CreditRepair.com is one of the best-known credit repair companies in the industry. This company has proven that its team has a great track record of disputing questionable items on clients' credit reports. If you're still not sure about CreditRepair.com, check out its numerous positive customer reviews.

How much does a credit repair company charge?

If you want help, you can hire a credit repair company to assist you. They generally charge anywhere from $19 to $149 a month for their services. But beware of scam credit repair offers, which may leave you in worse financial shape than before.

What is the role of credit repair?

Its primary role is to advise you on the credit repair process and provide ongoing support as you dispute inaccurate information. Some also offer a package of related services, such as credit monitoring . While some credit repair companies are national, others operate only in certain states.

What happens if you discover inaccurate information on your credit report?

However, if you discover inaccurate information, you have a right to challenge it, and the credit bureau is legally required to investigate. If the bureau decides you're right, it will strike that information from your credit report.

How long does it take to get your credit back after a credit repair?

Once you sign up with a credit repair company, it may be several months before you see results. It usually takes up to six months, or longer, for your credit to be totally repaired.

Can a credit repair company do for you?

As the Federal Trade Commission explains, there is nothing that a credit repair company can do for you that you can't do for yourself. The reason you might want to hire one is if you don't feel comfortable with the process or don't want to devote as much of your time to following it through to the end.

Is it illegal to pay upfront for credit repair?

Pressuring you to pay upfront. Some legitimate companies do require set-up or enrollment fees, but in general, forcing you to pay before any services have been performed is illegal, under the federal Credit Repair Organizations Act. Promises to get rid of any negative information on your credit report.

Can you change your credit report if you don't recognize it?

You'll also want to make sure that there are no accounts listed on your credit reports that you don't recognize. If there are, that may be a sign that an identity thief has opened credit accounts in your name. If the information in a credit report is accurate, there is nothing you can do to change it.

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act gives you the right to an accurate credit report, allowing you to dispute credit report information that’s inaccurate, incomplete, or cannot be verified. Credit repair is the process of removing this type of information from your credit report with the goal of improving your credit score.

What to look for in a credit repair company?

A professional website with complete service and pricing information, a business address, and a customer service number are also things to look for. Before choosing a company, compare plan details, online reviews, and Better Business Bureau complaints against other credit repair companies.

How long does it take for a credit repair company to cancel a contract?

Credit repair companies must follow the Credit Repair Organizations Act, which requires them to inform you of your right to repair your own credit, prohibits upfront payments, and gives you the ability to cancel your contract within three business days. 4 Any company not following this protocol is one to avoid.

How to get caught up on past due bills?

Working with a nonprofit consumer credit counseling agency is another worthwhile and cost-effective option. The agency can help review your finances, create a budget, and negotiate a debt management plan with your creditors to help you get caught up on any past-due bills.

Can I repair my credit score if it's not bad?

But even if your score isn’t bad, there’s probably room for improvement. Especially if the information dragging your score down is inaccurate. While you have the ability to repair your own credit, using a reputable and professional credit repair company is an option—if you can afford it and can verify that the company is legitimate.

Can credit repair companies remove credit information?

Credit repair companies don’t have the power to remove accurate, complete, and verifiable information from your credit report. Beware of any credit repair firm that guarantees specific results or promises to delete accurate information.

Do credit repair companies charge fees?

Legally, credit repair companies can’t charge fees until after they’ve performed services for you. 4 You’ll find that many credit repair companies charge a monthly subscription fee to cover the costs of work done for you in the previous month. Your total credit repair costs will vary depending on the company you choose and the amount ...

What is the final tier of credit repair?

The final tier of credit repair involves hiring someone to do all the work for you. These Credit Repair companies do the same thing you’d do on your own. The only difference is that you have a state-licensed attorney make disputes on your behalf.

When will credit bureaus release free credit reports?

Contact us at (800)-810-0989. Important Update: Bureaus Offer Free Weekly Reports Through April 2022. In light of the unprecedented financial crisis caused by the COVID-19 pandemic, the credit bureaus have expanded free credit report access.

Is it free to repair your credit?

The cost of credit repair varies widely based on what level of service you need. In fact, the process can be entirely free if you repair your credit on your own online. Just be aware that the trade-off for reduced costs is more work. The more you can accomplish on your own, the less you can expect to pay and vice versa.

Do premortgage credit corrections cost the most?

With that in mind, pre-mortgage credit correction services usually cost the most, because it can take a village to get your outlook ready to buy a home . Warning: If you pay for a credit repair service, make sure the company employs state-licensed credit repair attorneys.

Is paying for top level service overkill?

But if you just want a better credit score and don’t plan on applying for a loan or new credit card in the near future, then paying for top-level service is probably overkill. With that in mind, make sure you set your goals before you explore service providers and packages.

Do it yourself credit repair?

Do-it-yourself credit repair costs. When you repair your credit on your own, the cost ranges from nominal mailing charges to completely free. If you use the online dispute portals offered by each credit bureau to make disputes, you should have zero costs. Nominal mailing charges come into play if you send your disputes through physical mail.

What is credit repair?

Credit repair companies help remove errors from your credit report with the intent to increase your credit score. Some credit repair companies offer extra features in package upgrades, such as free credit score updates, writing cease and desist letters to debt collectors or even writing letters of recommendation to any lenders you’re applying ...

How to repair your own credit report for free?

Follow these five steps to do so: 1. Request a free copy of your credit report from each of the three bureaus at AnnualCreditReport.com. 2.

What is the best place to find a credit counselor?

If you truly are confused about your credit situation, consider working with a nonprofit credit counselor who can help you get back on your feet for a reasonable price. The National Foundation for Credit Counseling is a great place to find a reputable credit counselor.

What Does It Take To Repair Credit?

Ultimately, you can do just as good a job of cleaning up your credit report as most debt settlement or consolidation agencies say they can do. You can review your credit history for errors, remove old collection accounts, and improve your credit utilization ratio by getting new credit. But this takes time and effort that you may not have.

How Much Does a Credit Repair Company Cost?

Credit repair companies do not work for free. In fact, the majority of them charge hefty fees. If you are considering hiring a credit repair company, prepare to fork over at least a thousand dollars in most cases. There is usually a start-up fee of between $70 and $100, as well as a monthly fee that ranges from $70 to $150.

How To Evaluate a Credit Repair Company

Since credit repair companies can cost you $1,000 or more, it’s important to choose one that is legitimate and treats you well. You should always know exactly how much the credit repair companies charge. The Credit Repair Organizations Act gives you rights when choosing a credit repair company. By law, companies are required to tell you:

Credit Repair Scams

When it comes to credit repair, it’s important to do your due diligence because there are lots of scam artists out there who prey on innocent people. This is why you should always read customer reviews before you pay anything to anyone. According to the Fair Credit Reporting Act, scam companies will frequently do the following:

What is success fee?

A success fee is generated for a successful deletion or repair of an item. A repair is defined as an item in negative status being changed to positive status. An item is not considered repaired unless ALL negative information is removed from the reporting of the item. All prices are per item and per bureau.

Is there a risk with credit absolute?

With our 100% money back guarantee there is absolutely no risk because we do not charge until a service has been rendered. Yes, it’s that simple. With an average success rate of 70%, our money back guarantee, and the best credit education in the business, Credit Absolute is one of the wisest investments you can make for your future.