Full Answer

Can I start a credit repair business with no training?

You can start a credit repair business now, and add credit services to your current practice or business. We've trained, attorneys, mortgages brokers, real estate agents, tax professionals, and others since 1986 with our regularly updated materials. No Training is better!

How do I become a credit repair specialist?

Choose an appropriate major. While there aren't necessarily any specific education requirements for a credit repair specialist, most people working in the industry have at least a bachelor's degree in a finance-related discipline.

What insurance do I need to start a credit repair business?

Get any required insurance or bonding. The government may require liability insurance or other business insurance to protect both you and your clients from any mistakes you might make that would negatively impact their credit.

What do I need to know about credit repair laws?

Review applicable laws. Credit repair is a highly regulated business. As a credit repair specialist, you must understand what laws apply to your business even if you're working as an employee for someone else. For example, if you're based in the United States, there are federal and state laws that regulate the credit repair industry.

Do you need a license for credit repair in Texas?

Credit Repair Licensing in Texas A credit repair license in the state of Texas is not required; however, there may be county or city laws that would require you to obtain a local tax receipt, local professional license, or permit.

How do I start a credit repair company?

Start a Credit Repair Agency by following these 10 steps:Plan your Credit Repair Agency.Form your Credit Repair Agency into a Legal Entity.Register your Credit Repair Agency for Taxes.Open a Business Bank Account & Credit Card.Set up Accounting for your Credit Repair Agency.More items...•

Do you need a degree to start a credit repair business?

Education and Certification. Choose an appropriate major. While there aren't necessarily any specific education requirements for a credit repair specialist, most people working in the industry have at least a bachelor's degree in a finance-related discipline.

How much do credit fixers make?

While ZipRecruiter is seeing annual salaries as high as $80,000 and as low as $19,500, the majority of Credit Repair Agent salaries currently range between $27,500 (25th percentile) to $51,500 (75th percentile) with top earners (90th percentile) making $58,500 annually across the United States.

How much should I charge for credit repair?

Credit repair doesn't cost anything if you handle the process yourself. If you hire a credit repair company to assist you, you'll typically pay fees of $19 to $149 per month. There is nothing a credit repair company can do for you that you can't do for yourself.

Can you start your own credit bureau?

Consumers invisible to banks thanks to America's enigmatic credit-reporting system have a new tool at their disposal: Experian, one of the big three credit bureaus, is introducing a new program that will allow consumers to simply create their own credit reports from scratch, the Wall Street Journal reports.

How much does it cost to become a credit repair specialist?

The total cost to get started is less than $300.00. That includes a website and an online business portal. You have access to professional marketing materials. You'll be offering all of our services including credit repair.

How do I become FICO certified?

In order to receive this certification, candidates must agree to a code of ethics and successfully complete three one-hour online courses delivered by AllRegs Academy: Exploring FICO Scores, Analyzing the Credit Report, and Communicating Credit Information.

Is it illegal to do credit repair in Georgia?

No one can remove correct information from your credit report, even if it negatively reflects on you. It is illegal and a misdemeanor to operate a credit-repair services company of this type under Georgia law.

How profitable is a credit repair business?

Learn to repair credit for yourself and others and start your own profitable business from home. Credit Repair Professionals are always in demand and can earn $10,000 to $20,000 per month (or more). Some make millions of dollars a year and truly change lives.

Do credit repair agents make money?

How much does a Credit Repair Agent make in California? As of Jul 3, 2022, the average annual pay for a Credit Repair Agent in California is $39,639 a year. Just in case you need a simple salary calculator, that works out to be approximately $19.06 an hour. This is the equivalent of $762/week or $3,303/month.

Can I pay someone to fix my credit?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

What Budget Does It Require?

Like any startup, your business will need some capital — on average, $1,200. You need to invest to earn more in the long run. Fortunately, this niche is a genuine route to financial independence. The initial investment will return in its due time, and the profit potential is very impressive.

What Laws Will Apply?

The local industry is regulated by laws on the state and federal levels. The latter include the Credit Repair Organizations Act (CROA) and The Fair Credit Reporting Act (FCRA). Both protect citizens from exploitation by score fixers.

Bond: Why You Need It

Posting a surety bond is a requirement for licensing under the Texas Finance Code. This guarantees honesty and transparency of the subsequent operations. On the downside, if your credit rating is far from perfect, some entities may reject your requests. If this happens, look for alternatives.

Learn About the Licensing and Limitations

This statute of limitations regulates all debts within the state of Texas. It determines how much time a lender has to sue its client for payment. In the case of credit cards and debit, this may be done within seven years. This means you may only help the residents clean their reports within this period. Afterward, the issues vanish on their own.

The Bottom Line

Starting a credit repair business in Texas is a lucrative opportunity. The initial investment is relatively modest, but the potential for high revenues is undeniable. If you are determined to begin, understand that this niche is highly competitive, so standing out from the crowd will be crucial.

What is the Texas Administrative Code for credit service organizations?

According to the Texas secretary of state website, credit service organizations are governed by Chapter 393 of the Finance Code and the rules in the Texas Administrative Code Chapter 74.

How much does it cost to get a certificate of registration in Texas?

The fee for a certificate of registration is $100, which should be made out to the Texas secretary of state. If the CSO has multiple locations, a fee of $15 will be charged for each additional location.

1. Degree

While there are no specific education requirements for a career as a credit repair agent, a business degree gives you an edge. Focus on courses like accounting, economics, math, finance, business management, or consumer credit.

2. Negotiation and Communication Skills

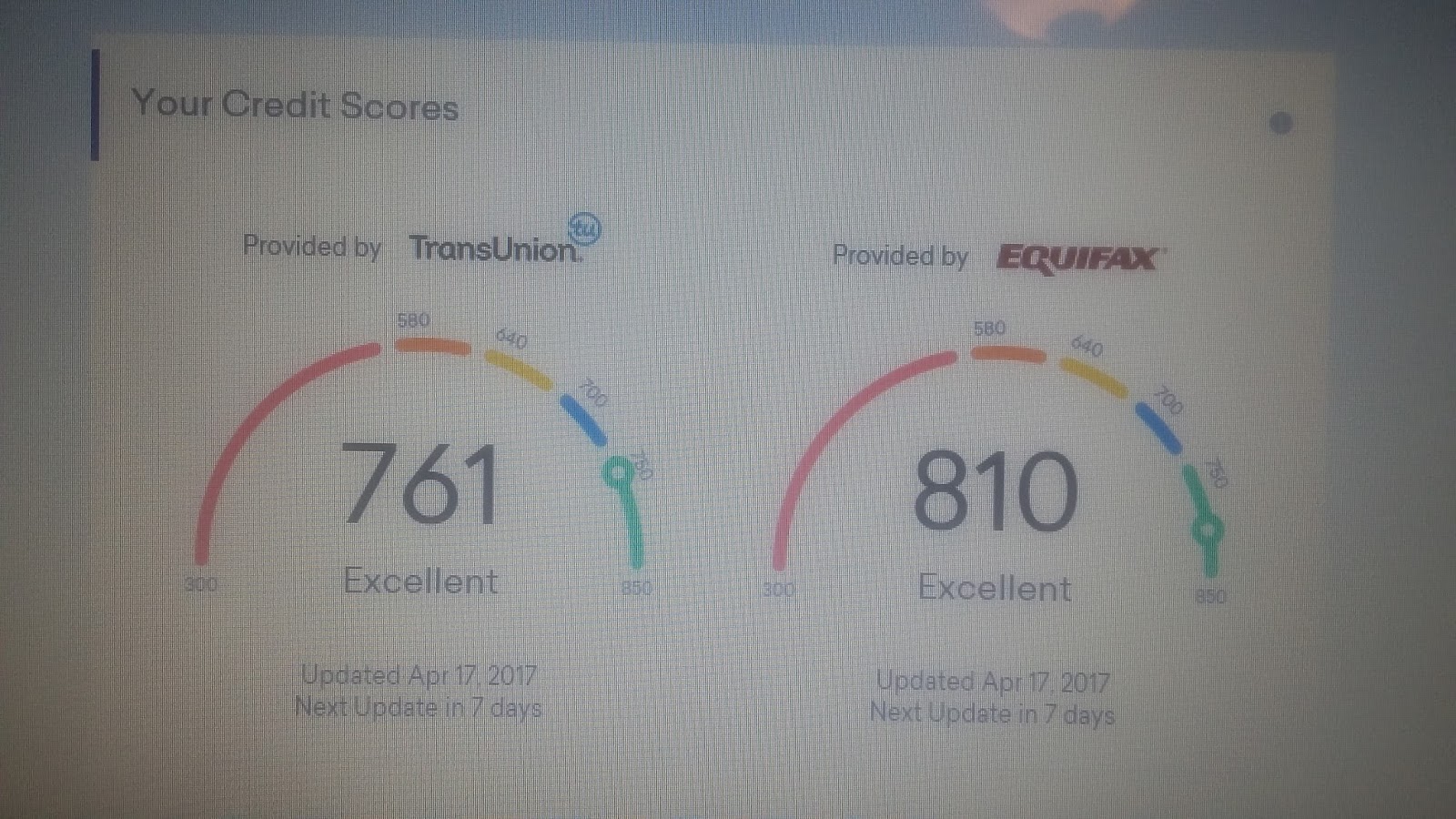

The majority of your job as a credit repair agent involves negotiating and communicating with credit bureaus. You need to be acquainted with how to get negative items off a credit report to help your clients improve their credit score.

3. Licensing and Insurance Requirements

If you are starting your own business, it’s important to research the credit repair insurance and licensing requirements in your state. Additionally, you need to partner with a payment processing company to open a credit repair merchant account when you’re ready to work with clients and accept payments.

4. Additional Credentials

Unlike other professions and specializations, being a credit repair agent will not take up too much by way of education; however, you have to continue training and completing certifications to keep up with the guidelines and updates.

5. Continuing Education

Once you are already a certified credit repair agent, you should not stop there as the industry encourages continued education. As with other industries, a career in the credit repair field requires a number of credit hours in continuing education to keep you up-to-date with the latest news, guidelines, or trends in this sector.

How to become a credit repair specialist?

To become a credit repair specialist, start by working toward a bachelor’s degree in a finance-related discipline and focusing on courses in personal finance. After you graduate, consider becoming certified in consumer credit issues to improve your trustworthiness with clients.

What is a credit repair franchise?

A franchise is something of a hybrid between starting your own independent business outright and joining another agency as a paid employee.

Is credit repair a regulated business?

Review applicable laws. Credit repair is a highly regulated business. As a credit repair specialist, you must understand what laws apply to your business even if you're working as an employee for someone else.

Join Us For Unlimited Income Potential In A Booming Credit And Financial Services Industry!!

What we do at Credit Repair USA is provide you the tools to succeed and run your own credit repair company. We provide all the credit repair processing infrastructure freeing you to build and market your own brand. Otherwise our partners have a passion to help others, an eagerness to have or expand a business, and a spirit of sales and growth.

Why Credit Repair USA?

With Credit Repair USA your back-office is built and staffed with professionals, the technology is purchased, and the processes are developed so you can focus on growing your income and business. The Credit Repair industry has been hot, is hot, and will be hot for the foreseeable future. Now is the time to join the Credit Repair USA team.

What You Get As An Affiliate

This is a great fit for Mortgage, Real Estate, Tax Professional, Auto, and professionals in industries dependent on credit.

How much do credit consultants make?

There are legal techniques available and consultants can easily earn an extra $1000-$2000 per month part-time or $6,000 to $25,000 per month full-time helping consumers with proven strategies to increasing their credit score.

Do you need good credit before hiring?

Additionally, as shown in the video, most jobs will perform a credit check prior to hiring. Therefore, good credit is needed like never before. Opportunity is knocking at your door because millions will seek help in getting their credit back on track.

Can you remove credit report information?

You will also have the public confidence to provide solid Credit Repair or Credit Score optimization services with a standard of excellence. Yes, it is technically true that no one can legally remove accurate and timely information from your credit report. But let's be honest, this is not the total the truth.

Do I need credit repair software?

You don't need credit repair software to get started right now. Yes, credit repair software is great but only if you are trained in the business first. Several credit repair companies run their employees through our certification process to make sure they are trained.

Is credit repair training ethical?

Yes, just being an ethical person. Yes, we will keep you abreast of changes and pending changes within the Credit Repair Industry . YES, our training is top of the line and you Do NOT NEED to pay any additional fees or thousands. This is why we list our prices.

Can I run a credit repair business?

You will be qualified to run a successful and rewarding Credit Repair Business. Yes, you will be helping others including families to get into homes and cars with your knowledge. You will plead to do NO harm to the public by providing tangible services for any funds received.