The following steps will help determine the after repair value (ARV) of a property:

- Estimate the Current Value of Property To estimate the as-is value of a property, it is best to have it appraised by a professional appraiser. ...

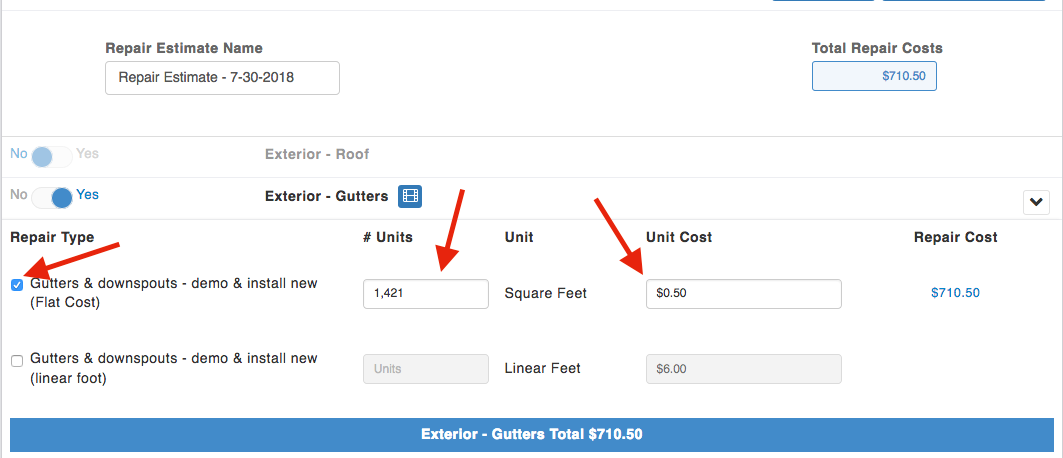

- Estimate Repair Costs & Value of Repairs After figuring out the property’s current value, the next step is to estimate the repairs needed and the value of those repairs. ...

- Find Comparable Properties

...

- ARV – After repair value;

- APS – Average price per sq. ft. or sq. m; and.

- AREA – Total area of the property.

What is the after repair value of a property?

The standard after repair value formula most wholesalers and rehabbers use to make offers is: 70% of the after repair value – repair cost = maximum offer price For example, if a property has an after repair value of $250,000 and the estimated repair costs are $55,000, the investor would use the formula:

What is after repair value (ARV)?

The after repair value is the value of a property after it's been improved, renovated, or fixed up. It's the estimated future value of the property after repair. ARV is determined by referencing nearby comparable properties (comps) in similar condition, age, size, build, and style that have recently sold.

How do you calculate repair costs when buying a property?

For example, if a property has an after repair value of $250,000 and the estimated repair costs are $55,000, the investor would use the formula: The maximum offer price is the most the investor should pay for the property, so most will start with a lower offer. The lower the purchase price, the more room for profit.

How do you calculate ARV when buying a fix and flip?

Side note for fix and flip investors: When calculating ARV, it can be useful to calculate a property’s current value—while it’s in need of serious rehab— and what the property will likely be worth after renovations. Plug this into your 70 percent rule calculations to determine a maximum allowable offer.

How do I find my home's ARV?

To get a more precise ARV, you can determine the average per square foot price (total sales price divided by the total square feet of the property), then multiply that price by the number of square feet in the subject property.

What does after repair value mean?

ARV, or after-repair value, is the estimated value of a property after completed renovations, not in its current condition. House flippers commonly use ARV as a way to gauge the worth of a fixer-upper property, including how much it can be bought, and then resold for after repairs.

How do I calculate the value of my home after renovation?

Here's a quick example: Say you recently purchased your house for $450,000, and you're remodeling your kitchen. Your estimate from the contractor for the project is $50,000. Your estimated ARV would be: $450,000 + (70% x $50,000) = $485,000.

How do you measure ARV comps?

9:0610:53How To Determine The After Repair Value Of A Property - YouTubeYouTubeStart of suggested clipEnd of suggested clipPer square foot of your comps. This is done by adding up all of the price per square foot comps thenMorePer square foot of your comps. This is done by adding up all of the price per square foot comps then dividing by the number of cons that will give you your average. So let's say that the average is

How do I get ARV on Zillow?

7:3213:01How To Figure Out ARV Of A Property In Minutes (PT.1, USING ZILLOW)YouTubeStart of suggested clipEnd of suggested clipPrice per square foot in the area very important number so average price per square foot in thisMorePrice per square foot in the area very important number so average price per square foot in this particular area is a hundred and fifty eight point two dollars per square foot.

What's ARV stand for?

ARVAcronymDefinitionARVApproximate Retail ValueARVAntiretroviralARVAdvanced Re-Entry Vehicle (aeronautics)ARVAnnual Rental Value (taxes)33 more rows

How do you calculate repairs?

1:016:48How To Calculate The Cost of Repairs On Any House In 60 Seconds!YouTubeStart of suggested clipEnd of suggested clipThe only way to get the exact cost of repairs is to get bids for labor and material from contractorsMoreThe only way to get the exact cost of repairs is to get bids for labor and material from contractors. And even that is subjective. Because what to do and what to fix and the greater.

How do you calculate improvement value?

The improvement value is the difference between the total purchase price of the commercial real estate property and the land value, plus the cost of buildings and other improvements added.

Is now a good time to remodel 2022?

Spending for home remodeling projects is expected to rise into 2022. A new Harvard University study predicts that spending on home remodeling and maintenance will increase by 8.6% through the middle of 2022. Integrators are seeing an increase in opportunities from projects coming from homes that already exist.

What does 70 ARV mean?

After Repair ValueThe 70% rule says that an investor should spend no more than 70% of a property's After Repair Value (ARV) on a property. This includes the price you pay for the property itself as well as any estimated repair costs.

How do you calculate a 70% rule?

In the rule of 70, the “70” represents the dividend or the divisible number in the formula. Divide your growth rate by 70 to determine the amount of time it will take for your investment to double. For example, if your mutual fund has a three percent growth rate, divide 70 by three.

What is ARV in pharma?

Manufacturers of antiretroviral (ARV) drugs have assured the government of increasing production to meet the demand for medicines in the wake of coronavirus outbreak in the country. The total number of confirmed coronavirus cases in India have reached 119.

Why after repair value is important?

ARV is an essential factor for real estate investors who flip houses because it helps them determine the valuation of particular properties so they can maximize profitability and return on investment (ROI).

What is after value?

After-repair value (ARV) is an estimate of the value of a property after it's repaired. This serves as a proxy for the market value of the price. The most common use of ARV is in house flipping, when an investor buys a distressed house, fixes it up then sells it, typically within a year.

What is an ARV appraisal?

“ARV” stands for “After Repaired Value.” And determining the ARV comes from our appraiser. We send an appraiser out to the property to tell us how much that home is going to be worth after you complete the repairs.

What is ARV in wholesaling?

The ARV (after repaired value) on a house is one of the most important things to know when flipping houses. It is also one of the most important things to know when buying rentals or wholesaling properties. ARV stands for “After Repaired Value” and is what the home will be worth once it is fixed up.

What is after repair value?

After Repair Value is not the price of a new property, but the price of the property after re-furnishing or making some improvements to an existing property. It is used by a person who buys any sort of property, makes necessary improvements to increase its efficiency within a period of a year, and then sells it off.

What is the value of a property after repair?

After Repair Value is basically the sum of the purchase price of the property and the cost incurred in repair and hence, one needs to figure out the cost of repair in order to get a good profit after selling the property.

How to find ARV?

There are multiple approaches in the estimation or calculation of ARV, but the best way of finding ARV is by employing the 70% rule, a barometer used while purchasing distressed property in hope of later profits differentiates between modern home and contemporary home design. This method of calculation would be particularly helpful for flip-flop investors to estimate the future value of the property that is to be sold, and would, in turn, motivate them to invest more in such properties where they can gain sufficient returns.

Why should the current value of a property be valued by a professional appraiser?

The current value of any property should be valued by a professional appraiser to ensure that the correct value is calculated. Services of certified websites can be employed to find out or compare the value of the property with other properties in the market. It is imperative to collect maximum information like flood certification on the property so that the best price or value of any property can be determined accurately.

How to estimate future value of property?

The best way to estimate the future value of any property is by using ARV. The data collected and information gathered need to be accurate and genuine to ensure the calculation of the correct value. If the future properties’ value can be accurately estimated, it will enable the investors to invest accordingly in any property.

Why compare the price of a property with other properties in the existing market?

Compare the price of the property with other properties in the existing market to ensure that sufficient profit is generated after selling it.

What is 70% ARV?

The 70% ARV rule is used to find out the maximum bid price of any property. The rule bids the 70% price of the expected selling price post deduction of the repair cost, hence ensuring that there will be returns of around 30% for the investors.

What is the goal of a quick and dirty valuation?

But this is a quick-and-dirty valuation, so you can be a little less precise. Your goal is to achieve an upper and a lower value limit— the range in which your subject property might fall.

What is SCA valuation?

Real estate brokers and appraisers use the SCA to estimate market value by comparing and contrasting multiple properties. Investors often buy fixer-uppers, so this valuation helps you understand a property’s potential value—also called the after repair value (ARV).

What to do if you don't do a quick and dirty analysis?

If this weren’t a quick-and-dirty analysis, you would make some detailed adjustments. You would estimate the value of each feature of a house (like a garage, a deck, or a fireplace) and add or subtract from the comps to compare apples to apples.

Is it expensive to do your own valuation?

No. It’s impractical and expensive. You need your own quick-and-dirty valuation process. And even when you do hire an expert, why completely depend upon someone else for one of your most important business calculations? I do my own valuations and then compare that with the appraiser or agent’s value.

Can you become a value expert overnight?

Valuation is not a skill you can master overnight. Expertise takes years—but you can become quickly competent. By applying it strategically and regularly, you can become a value expert in a very small slice of your overall market. You can become the person who knows more about your niche than anyone else.

Can markets change?

And that’s exactly what we’re trying to do. We’re projecting past market information into an unpredictable future. Markets can and do change very fast.

Is an estimate similar to an expert's?

Most of the time, my estimate is similar to the expert’s. But happily, the expert sometimes offers helpful insights—and occasionally I find the expert is wrong. Being wrong hurts because it loses money.

What is the meaning of ARV?

ARV is an abbreviation of after repair value. Investors mainly use this term in real estate.

How to use the after repair value calculator?

With our free ARV calculator, you have two methods to determine how the after-repair value helps your business, along with what should be the maximum bidding amount and the potential ROI based on your budget.

How to calculate the ARV of a property using the ARV real estate formula?

Here's how to calculate the ARV of a property manually and make quick calculations of your potential ROI.

What is after repair value?

The after repair value (ARV) is one of the most common terms used when talking about the fix and flip real estate strategy. So, here is all you need to know about the ARV.

Why Is the After Repair Value Important?

For one, you will need it to estimate renovation cost, the property’s value after the renovation, and the amount of rent to charge for those investors who work with long-term rentals.

What Are the Disadvantages of the ARV?

At times, unexpected renovations pop up as the project is ongoing. Or real estate market trends may shift leading to a different ARV once the project is done. A professional appraiser might be of help to avoid inaccuracies, but you will have to add that to your investment expenses since you are going to have to pay for the service.

What is the value of a renovation?

These costs need to be less than the renovation value in order for you to make a profit. The renovation value is the added value of the investment property after you have repaired it. For example, let’s say you bought a distressed home for $90,000. You repair the house, and the repair cost is $20,000. Let’s say the renovations caused the property price to jump to $140,000 (which you confirm in the next step). So the value of renovations is actually $50,000 while the cost was only $20,000. Your profit would then be $30,000.

How to get the most accurate valuation of a property?

Estimating the current value of the investment property is the first step to take. For this, you might want to hire a professional home appraiser. They will help you get the most accurate real estate valuation as they will know how to account for any defects in the distressed property. Having the most accurate estimation of the property’s current value will help you make sure you negotiate to get a below market value deal.

What happens if the after repair value is higher than the renovation cost?

If the after repair value of your property means that your renovation value is higher than the renovation costs (like the example shown above), you will make your desired profit. If not, then you might want to reevaluate the entire situation.

Is an investment property sold at below market value?

Since you are buying an investment property in an “as-is condition”, it is likely to be sold to you at below market value. As for the second component, it is the value of the real estate renovations that you plan on carrying out. Although both components seem very simple, this is far from reality.

What Is After Repair Value (ARV)?

After repair value (usually shortened to ARV) refers to a property’s estimated market value after it undergoes specific repairs and renovations.

How ARV Works in Real Estate

After repair value, or ARV, is commonly used in house flipping, a short-term real estate investment strategy in which a person buys a property (often a “fixer-upper” or distressed property), makes repairs and renovations, then sells it for a profit.

What Is the 70 Percent Rule in Real Estate?

House flippers and other property resellers often operate within the “70 percent rule,” a rule of thumb that recommends only buying a property priced at no more than 70 percent of the after-repair value (ARV), minus the cost of renovations.

How to Calculate ARV

If you want to purchase a home and need to know the property’s value after repairs and renovations, you can either hire an appraiser to do a comparative market analysis (CMA) or do your own rough calculation. If you prefer to do it yourself, you don’t need an ARV calculator. Here’s a step-by-step guide to help you determine a home’s ARV:

Ready to Learn the Ins and Outs of the American Housing Market?

All you need is a MasterClass Annual Membership and our exclusive video lessons from prolific entrepreneur Robert Reffkin, the founder and CEO of the real estate technology company Compass.

The 5 Steps To Determining Arv

Search the MLS (or third-party sites) for recently sold homes in the same neighborhood as your subject property.

Video Tip

To see FreeComps in action check out Jerry Norton’s YouTube video HERE.

ALL PROFITS BEGIN WITH AFTER REPAIR VALUE

Figuring out an accurate after repair value, or ARV, on your deal is the make-or-break skill for real estate investors. Once you have potential sellers reaching out to you, then it’s time to determine if any of those deals are worth pursuing. An accurate ARV helps you know what you can offer on the deal and still make a profit.

THE SPEED TO COMPLETE YOUR DEAL

Once you’ve placed an offer, you need to get values done fast so you can move forward—or risk losing the deal.

TRANSPARENCY

When we do your Desktop Evaluation, our team member will do a screen recording of what they’re looking at and how they came up with their values. If your deal doesn’t qualify for a loan, you’ll know exactly what went wrong and how to find a better deal next time.