8 Easy Steps — How to Fix Your Credit Score Fast

- Check Your 3 Credit Reports. No matter how you got into your current credit predicament, the first step to fixing it will always be to do a thorough check ...

- Remove Errors & Unsubstantiated Accounts. Once you have all of your credit reports in hand, you should carefully inspect them for any inaccurate, out-dated, or unsubstantiated information and accounts.

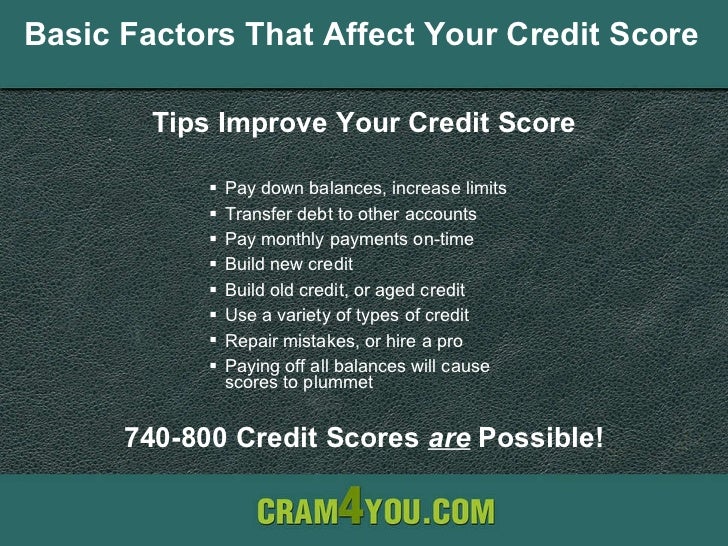

- Pay Down Balances. Of all the ways you can improve your credit score, perhaps the one with the quickest results is to pay down your existing balances, particularly credit ...

- Decrease Your Interest Rates. If you’re stuck dealing with bad credit, of course, telling you to pay down your debt is likely quite redundant.

- Communicate with Your Creditors. People in debt may sometimes feel their creditors are out to get them, that card issuers and lenders are hoping consumers fall behind and become ...

- Automate Your Payments. At the end of the day, of course, the easiest way to fix the credit damage wrought by missed payments, is to avoid having missed payments ...

- Periodically Use Old Cards. Many consumers who have battled their way through bad credit are inclined to throw away their old credit cards as they pay them off, or, ...

- Apply for New Accounts Wisely. While it’s important to keep your older accounts open, it’s just as important to be careful about how and when you open new accounts.

- Pay credit card balances strategically.

- Ask for higher credit limits.

- Become an authorized user.

- Pay bills on time.

- Dispute credit report errors.

- Deal with collections accounts.

- Use a secured credit card.

- Get credit for rent and utility payments.

How to fix your credit score in 5 steps?

improve your credit score is pay your bills by the due date. You can set up automatic payments from your bank account to help you pay on time, but be sure you have enough money in your account to avoid over-draft fees. 3. Understand how your credit score is determined. Your credit score is usually based on the answers to these questions:

How do you fix your credit score fast?

Improving your credit score

- Monitor your payment history. Your payment history is the most important factor for your credit score.

- Use credit wisely. Don’t go over your credit limit. ...

- Increase the length of your credit history. ...

- Limit your number of credit applications or credit checks. ...

- Use different types of credit. ...

How to successfully repair your credit all by yourself?

Quick Tips for Repairing Your Credit

- Lower Your Credit Utilization Ratio. Remember that credit utilization ratio we talked about earlier? ...

- Request a Credit Limit Increase on Credit Cards. ...

- Become an Authorized User. ...

- Consolidate Your Credit Card Debt. ...

- Get a Credit-Builder Loan. ...

How to improve your credit score fast?

There are 8 things you can do to boost your credit score in 30 days… Make sure you obtain a copy of your credit report. Find out why negative accounts have been maintained. Take legal action to resolve the problem with the credit bureaus. Request a dispute credit check. The balance on your credit card needs to be paid.

How can I improve my credit score in 30 days?

This article will discuss four simple ways to improve your credit score in the next month.Pay Off Credit Card Debt. Your credit utilization ratio is a major factor used to determine your FICO credit score. ... Ask for a Credit Limit Increase. ... Become an Authorized User. ... Dispute Inaccurate Data on Your Credit Reports.

How can I raise my credit score 200 points in 30 days?

How to Raise Your Credit Score by 200 PointsGet More Credit Accounts.Pay Down High Credit Card Balances.Always Make On-Time Payments.Keep the Accounts that You Already Have.Dispute Incorrect Items on Your Credit Report.

How can I fix my bad credit ASAP?

How To Fix Your Credit In 7 Easy StepsCheck Your Credit Score & Report. ... Fix or Dispute Any Errors. ... Always Pay Your Bills On Time. ... Keep Your Credit Utilization Ratio Below 30% ... Pay Down Other Debts. ... Keep Old Credit Cards Open. ... Don't Take Out Credit Unless You Need It.

How long does it take to rebuild a 500 credit score?

Average Recovery Time For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.

Can I buy a house with a 515 credit score?

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you need to pay only 3.5% down. Those with lower credit (500-579) may still qualify for an FHA loan. But you'd need to put at least 10% down, and it can be harder to find lenders that allow a 500 minimum credit score.

How long does it take to build credit from 600 to 700?

It usually takes about three months to bounce back after a credit card has been maxed out or you close an unused credit card account. If you make a single mortgage payment 30 to 90 days late, your score can start to recover after about 9 months.

How can I wipe my credit clean?

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 7–10 years.

Can I pay someone to fix my credit score?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

How do I get a collection removed?

You can ask the current creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How long does it take to go from a 700 to 800 credit score?

The amount of time it takes to go from a 700 to 800 credit score could take as little as a few months to several years. While your financial habits and credit history will play a role in how long it takes, there are some factors that have specific timelines.

How long does it take to build credit from 0 to 700?

It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. 1 FICO credit scores range from 300 to 850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

How do I get my credit score from 500 to 700?

How to Bring Your Credit Score Above 700Pay on Time, Every Time. ... Reduce Your Credit Card Balances. ... Avoid Taking Out New Debt Frequently. ... Be Mindful of the Types of Credit You Use. ... Dispute Inaccurate Credit Report Information. ... Don't Close Old Credit Cards.

The Most Important Credit Score Factors

Certain credit score factors are more important than others. Payment history and credit utilization ratios are among the most important in many cri...

How Changes Affect Scores

One common question involves understanding how very specific actions will affect a credit score. For example, will closing two of your revolving ac...

Take These Steps to Improve Your Credit Score

Paying your bills on time is the most important contributor to a good credit score. Even if the debt you owe is a small amount, it is crucial that...

More Tips to Improve Your Credit Score

In addition to keeping a positive payment history and a low credit utilization ratio, you can take other steps to improve your credit scores, inclu...

How Long Does It Take to Rebuild A Credit Score?

If you have negative information on your credit report, such as late payments, a public record item (e.g., bankruptcy) or too many inquiries, you m...

Things You Might Not Know About Credit Scores

Credit scoring is a complex calculation, and the more you know about how credit reports and credit scores work, the better you can take control of...

First Step: Check Your Credit

The first thing you need to do is get your credit reports and credit scores from each of the credit bureaus so that you can gauge where you’re at a...

What Will I See on These Reports?

You’ll see basic details about yourself — your name, birthday, address, etc. It’s important to review these to make sure they’re accurate. Note: Pa...

You Can’T Fix Bad Credit in 30 Days

We get it — you’ve found problems. Whether they’re errors or areas you need to focus on you may find yourself wanting results quickly, however, the...

How Long Does It Take to Repair My Credit?

If you have accurate negative information on your credit reports, then it can take a while for it to age off. Here’s how long negative marks remain...

Steps to Rebuild Your Credit

Remember, your path to better credit will vary significantly depending on your credit score problems. Here’s how to rebuild it.

Why You Should Fix Your Credit

There are many reasons an individual should start on the path to credit repair. Some of the bigger reasons include the advantage of saving money on...

How to fix my credit score?

No matter how you got into your current credit predicament, the first step to fixing it will always be to do a thorough check of your credit reports — all three of them. That’s right, you have three, one from each major consumer credit bureau: Equifax, Experian, and TransUnion.

How much does a new credit account affect your credit score?

Not only does each new account decrease your average account age — which contributes to 15% of your credit score — but every application for a new credit account will be taken into consideration, as well. Indeed, new accounts make up a full 10% of your score calculation.

What happens when creditors pull your credit report?

2. Remove Errors & Unsubstantiated Accounts.

What is the highest credit score?

While the range of possible credit scores can vary based on the model used to calculate your score, the two most popular models, FICO and VantageScore, use a scale of 300 to 850, with 850 being the highest (best) you can score.

How long can you keep a credit card unused?

Issuers will often close old credit accounts that have gone unused for more than 12 months. The main exception to this is if your credit cards carry annual fees. In this case, you’ll have to consider the cost of paying the annual fee against the potential cost to your credit score of closing the account.

How long does a negative credit report last?

Hard credit inquiries, for instance, should drop off your report in no more than 24 months, while missed payments and delinquent accounts can hang around for seven years. Bankruptcy discharges are the worst, lasting up to 10 years. 3.

What to look for in a fraud report?

Specific mistakes to look for on your reports include simple issues, such as misspelled names, to more complex problems, like the results of identity theft. For example, you’ll need to ensure that your report only shows accounts that actually belong to you — and that you were the one who opened them — as well as looking into administrative issues like verifying that your open and closed accounts have the correct status.

How to fix my credit score?

1. Get a Copy of Your Credit Report and Your Credit Score. Credit repair begins with a copy of your credit report. After all, without your credit report in hand, you won’t know what needs fixing, or how to fix your credit. Three major credit bureaus exist in the United States:

How long does it take for a credit report to change?

Credit bureaus must respond to disputes within 30 days and have to remove erroneous information immediately, so if you report a genuine error, you could see your score change for the better within a month depending on other factors in your credit report. 3.

How much of your credit score hinges on your average credit score?

Roughly 15% of your credit score hinges on your average credit age. If you’re new to the credit world, apply for a credit builder or secured credit card and use it sparingly to begin generating a credit history. Credit builder loans can help in that regard, too.

How long does a late payment stay on your credit report?

Late payments can stay on your record for a full seven years, so try your best to stay on schedule.

What factors are included in credit score?

Account time, account age, number of payments made, missed payments, late payments and other facts are all included. Payment history, credit utilization, credit type, account age and credit inquiries all factor into your credit score.

Can you apply for too many credit cards in a short time?

Finally, don’t apply for too many credit accounts in a short space of time.

Is a credit blunder real?

Genuine credit blunders are hard to stomach, but they are real. Errors, on the other hand, need extraction. If you notice a mistake on your credit report, you have two options: