16 Steps to Fix Credit Scores by Yourself

- Step 1: Order credit reports from the major credit bureaus. When working with a credit repair company, the first step...

- Step 2: Check the reports for potential dispute candidates. The second step in do-it-yourself credit repair entails...

- Step 3: Dispute incorrect information via mail or online. The FCRA states that customers...

- Check Your Credit Score & Report. ...

- Fix or Dispute Any Errors. ...

- Always Pay Your Bills On Time. ...

- Keep Your Credit Utilization Ratio Below 30% ...

- Pay Down Other Debts. ...

- Keep Old Credit Cards Open. ...

- Don't Take Out Credit Unless You Need It.

What is the best way to repair my credit score?

How to Repair Credit in 5 Fast Steps

- Assess the Damage and What Needs Repairing. You can’t know what’s hurting your credit without reading over your most recent credit reports, so you want to pull them ...

- Begin the Dispute Process. As per the Fair Credit Reporting Act, consumer credit reports must only contain accurate and timely information.

- Halt Further Credit Report Damage. ...

How to improve your credit score all by yourself?

You can control your credit utilization by:

- Paying down revolving credit debt, focusing first on cards or lines that are close to their limit

- Requesting an increase in your credit line if you are a good customer with a solid payment history

- Paying more than once in a billing cycle; adding in a payment mid-month may lower the balance that is reported to the agencies

How can you improve your credit score?

the more your spending limit can be. But hitting your spending limit frequently is going to lower your credit score. It is advisable not to exhaust your spending limit and stay under 30%. You can go higher in emergencies but going higher regularly is bad ...

How to rebuild my credit score?

How to Rebuild Credit in 7 Steps & How Long It Will Take

- Review Your Credit Report. In order to fix a problem, you must first know what it is. ...

- Catch Up on Past-Due Bills. If you don’t address the exact cause of your bad credit, the damage is likely to worsen the longer it goes untreated.

- Budget & Build an Emergency Fund. ...

- Use a Secured Credit Card Responsibly. ...

- Check Your Credit Score Regularly. ...

How can I fix a messed up credit score?

How to Improve a Bad Credit ScoreCheck Your Free Credit Score. First, check your credit score for free to view the factors that are most affecting it. ... Pay Your Bills on Time. ... Pay Down Debt. ... Avoid New Hard Inquiries. ... Boost Your Credit. ... Get Help Building Credit.

How can I fix my credit in 6 months by myself?

Pay Your Credit Card Bill On Time. ... Balance Your Credit Portfolio. ... Review Credit History Length. ... Minimize Hard Inquiries. ... Improve Your Debt Ratio. ... When Paying Off Credit Cards – Consider Doing So in Two Steps. ... Improve Utilization Ratio By Asking for Credit Limit Increases. ... Associate with Someone Who Has Excellent Credit.More items...•

Can you fix a ruined credit score?

Paying down debt, applying for a secured card and disputing errors are all solid options to repair your credit.

How can I restore my bad credit?

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month. ... Think About Your Credit Utilization Ratio. ... Consider a Secured Account. ... Ask for Help from Family and Friends. ... Be Careful with New Credit. ... Get Help with Debt.

Can I pay someone to fix my credit?

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

How can I clean my credit record?

How to Clean Up Your Credit ReportPull Your Credit Reports. ... Go Through Your Credit Reports Line by Line. ... Challenge Any Errors. ... Try to Get Past-Due Accounts Off Your Report. ... Lower Your Credit Utilization Ratio. ... Take Care of Outstanding Collections. ... Repeat Steps 1 Through 6 Periodically.

How can I raise my credit score 200 points in 30 days?

How to Raise Your Credit Score by 200 PointsGet More Credit Accounts.Pay Down High Credit Card Balances.Always Make On-Time Payments.Keep the Accounts that You Already Have.Dispute Incorrect Items on Your Credit Report.

Is 650 a good credit score?

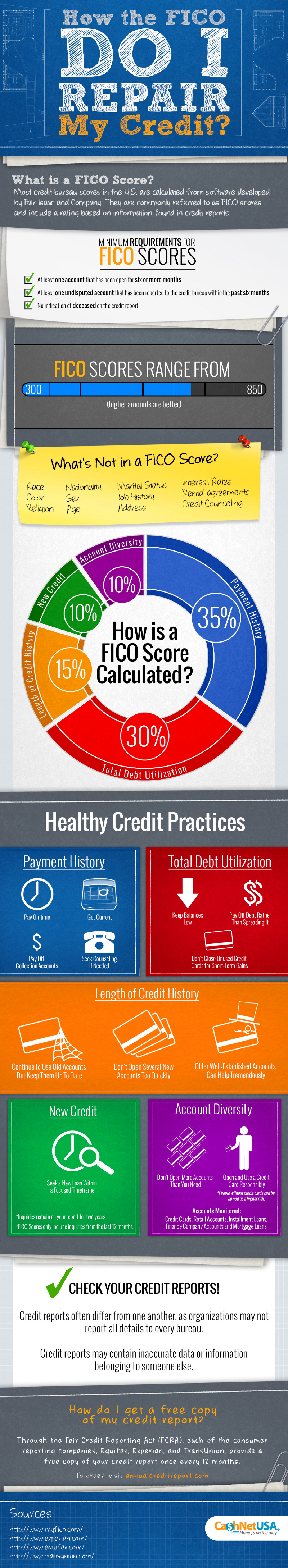

A FICO score of 650 is considered fair—better than poor, but less than good. It falls below the national average FICO® Score of 710, and solidly within the fair score range of 580 to 669.

How long does it take to repair credit score?

“It's often possible to earn a higher credit score in 30 days or less,” says Grant, but don't expect your credit score to move from fair to excellent during that time. If you've had a major setback, it usually takes about one to two years to repair your credit, according to Weaver.

What is the fastest way to rebuild bad credit?

Then consider these six basic strategies for rebuilding credit:Pay on time. Pay bills and any existing lines of credit on time if you possibly can. ... Try to keep most of your credit limit available. ... Get a secured credit card. ... Get a credit-builder loan or secured loan. ... Become an authorized user. ... Get a co-signer.

How can I get 700 credit score in 6 months?

Here's how I used a credit card to build my credit score from 0 to 700+ in 6 months:Apply for an Easy Credit Card. ... Set up Automatic Payments. ... Buy ONLY What You Can Pay Back. ... Use as Little Credit as Possible. ... Don't Fall in Love with Your Card. ... 6 Ways to Keep Your Credit Score High.More items...•

How much can my credit score go up in 6 months?

If your credit score is “under construction,”there's hope: You can boost your score fairly quickly and even see improvement in as little as a month. In fact, with some concentrated effort, it is entirely possible to raise your score by 100 points or more within six months or so.

Can I raise my credit score by 100 points in 6 months?

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Is it possible to raise your credit score 200 points in 6 months?

It may take anywhere from six months to a few years to raise your score by 200 points. As long as you stick to your credit rebuilding plan and stay patient, you'll be able to raise your credit score before you know it.

What Is The Credit Repair Organizations Act?

The Credit Repair Organizations Act is a federal law that became effective on April 1, 1997 in response to a number of consumers who had suffered f...

How to “Fix” Your Credit by Yourself

There is no quick fix for your credit. Information that is negative but accurate (such as late payments and delinquencies) will remain on your cred...

More Options For Credit Repair

If your debt feels overwhelming, it may be valuable to seek out the services of a reputable credit counseling service. Many are non-profit and char...

How does credit repair work?

In general, credit repair software tools work by scanning your credit reports (entered either manually or automatically through the software) and then allowing you to identify the entries you wish to dispute. Once the erroneous entries have been identified, the software takes over and can create, track and manage the dispute process, generate dispute letters, graphically display the progress of your disputes, and more.

How to dispute a negative credit report?

Dispute Negative Items by Writing Letters to the Bureaus 1 A separate dispute letter is required for each erroneous entry you are disputing. 2 Attach a recent copy of your credit report with the erroneous entry highlighted and with the front page included. 3 Keep your dispute letter clear and simple. State only the relevant facts, and explain the reason for disputing the entry. 4 Be sure to include copies of any relevant documents supporting your claim. 5 If you know who the furnisher of the disputed information is, send them an identical letter at the same time. 6 Keep copies of all your correspondence with the reporting agencies, along with dates sent.

How to remove a credit report if it is erroneous?

If the agency finds that the entry is erroneous, they must remove it from the report. Writing a letter to the credit reporting agency or agencies that have listed the erroneous entries on your report is the easiest way to get them removed.

What is credit repair software?

Credit repair software still lets you take control of your DIY credit repair, but offers extra help in the form of step-by-step guidance and formatted templates for you to use.

What is a credit detailer?

Functionally the same as the much more expensive Professional Edition, the Credit Detailer for home users is a powerful credit repair tool. It contains information on credit repair regulations and consumer rights, and is designed for both effective credit repair and educational opportunity. Simple, automated and customizable, Credit Detailer is worth checking out.

What is the best defense against credit reporting?

Let’s face it, when you’re up against a system that’s as large as the credit reporting industry, educating yourself on your rights as a consumer is your best defense. Toward this end, it’s often worth spending a little money to read about strategies written by experts in credit repair and the credit dispute process. A great place to begin this research process is to check out some of the current eBooks written on the subject.

How to remove negative entries from credit report?

Negative entries on your credit report that are either erroneous or inaccurate can often be removed by simply writing a letter to the reporting agency. In fact, the Fair Credit Reporting Act (FCRA) states that the credit reporting agencies must investigate any disputed entry a consumer discovers on their credit report.

What does the letter J mean on a bank account?

Look for the letters J and A, as these denote that you are a Joint account holder or an Authorized User on the account listed.

What does it mean to get your credit score sorted out?

Getting your credit score/history/report sorted out before you get pre-approved for mortgage financing will help determine the kind of mortgage you qualify for and the cost or interest rate. There is no shortage of companies offering to help fix your credit and increase your credit score; some are legitimate with real results, ...

What to do if your credit report shows an unpaid charge off?

If your credit report is showing an old collection or charge-off account as unpaid and you can provide evidence that you had in fact paid it off, contact the credit reporting agencies, send them your proof and ask them to change the status to paid. A paid charge-off or collection account is better than an unpaid one.

How to fix my credit score?

This is a fairly easy fix that can have a big impact on your credit score. Call up mom or dad, your ex-spouse, your old business partner or whoever it is, and ask them to make a call and have you removed from the account. Maybe tell them you are thinking about buying a house and you are trying to get your credit in order. Just in case, follow-up in a couple of days to make sure they took care of it.

Where are the letters on credit report?

In the body of your credit report, down where the accounts are listed, there are letters all the way to the left for each account under the ECOA heading. These letters are key codes for how a particular account is classified or held and by whom.

Can you remove authorized user from credit card?

But if you have established credit (and are no longer actively using these accounts -usually credit cards), you may want to have the primary account holder remove your Authorized User or Joint status. This is an especially good idea if the account has late payments or is at or close to its credit limit.

Is it good to leave an old age account alone?

For example; if you are an Authorized User or a Joint account holder on a seasoned account that is not over-utilized and has a good payment history, you may just want to leave that account alone. Old age is a good thing when the subject is credit; established accounts opened long ago will have a positive impact on your credit score.

How long does it take for TransUnion to send credit report?

The CRBs notify customers of any changes by sending an updated credit report. For instance, TransUnion will send the report using first-class US mail after 3-5 days following the completion of the investigation. If you file online, you can easily track the status of disputes.

How long does it take for a credit bureau to respond to a CRB request?

They request them to verify the entry in conflict. Creditors or public information sources have 30 days to respond to CRB requests.

What is the first step in a credit repair company?

When working with a credit repair company, the first step they take is checking reports for errors. They rely on paid third-party partners and later pass on the fees as part of initial costs.

Why do we need consumer statements?

Consumer statements can help explain reasons for negative items. They may be handy when you disagree with the results of investigations. It can be a way of opening a new line of conversation with a potential lender, employer, or landlord as they review reports.

What is DIY credit repair?

DIY credit repair en tails trying to clean up reports without the help of paid credit repair services. It’s a viable option for people who want to save on fees. Performing credit repair yourself is possible thanks to the Fair Credit Reporting Act.

Is DIY credit repair good?

DIY credit repair has its appealing qualities. From an individual standpoint, it may boost your problem-solving skills and contribute to personal growth. Becoming an expert on credit repair strategies is a skill that will be invaluable for the rest of your life. It can even mean helping close friends and family members with their credit issues.

How to fix my credit score?

1. Get a Copy of Your Credit Report and Your Credit Score. Credit repair begins with a copy of your credit report. After all, without your credit report in hand, you won’t know what needs fixing, or how to fix your credit. Three major credit bureaus exist in the United States:

What are the factors that affect your credit score?

Account time, account age, number of payments made, missed payments, late payments and other facts are all included. Payment history, credit utilization, credit type, account age and credit inquiries all factor into your credit score.

Why does credit mix make up 10% of credit score?

Why? Because lenders want to know that you can handle both types of credit accounts responsibly. Try to balance installment accounts like car loans and mortgages with revolving credit accounts like credit cards and lines of credit.

How long does it take for a credit report to change?

Credit bureaus must respond to disputes within 30 days and have to remove erroneous information immediately, so if you report a genuine error, you could see your score change for the better within a month depending on other factors in your credit report. 3.

How to avoid predatory loans?

The Best Way to Avoid Predatory, Bad Credit Loans and Hard Money Lending Companies Is to Improve Your Credit to Qualify for Better Interest Rates for Your Personal and Business Credit.

How much of your credit score hinges on your average credit score?

Roughly 15% of your credit score hinges on your average credit age. If you’re new to the credit world, apply for a credit builder or secured credit card and use it sparingly to begin generating a credit history. Credit builder loans can help in that regard, too.

How long does a late payment stay on your credit report?

Late payments can stay on your record for a full seven years, so try your best to stay on schedule.

What is experian boost?

Experian Boost ™ is another way for people with a poor or limited credit history to get ahead. Many times, these people will have a positive, consistent record of paying utilities on time, but those payments aren’t being included in their credit profile. Experian Boost™ allows people to include this payment history to their credit score. Best of all – it’s completely free.

How long does it take to respond to a credit report?

The reporting agency has 30 days from the receipt of your letter to respond. The Federal Trade Commission provides advice on contacting the credit bureaus about discrepancies. Here are the contact numbers and web sites for the three credit bureaus: Experian : 1-888-397-3742 – www.experian.com.

How to dispute a false credit report?

Write a letter to the specific credit reporting agency that shows the falsehood, whether it is Experian, Equifax, or TransUnion. Explain the mistake and include a copy of the highlighted report along with your documentation. Although certain bureaus now let you submit disputes online, it’s not a bad idea to send this letter by certified mail, and keep a copy for yourself. The reporting agency has 30 days from the receipt of your letter to respond. The Federal Trade Commission provides advice on contacting the credit bureaus about discrepancies. Here are the contact numbers and web sites for the three credit bureaus:

What to do after you get a copy of your credit report?

Once you have the copy of your full credit report in hand, check your identity information (Social Security number, spelling of your name and address), and credit history.

What is the next step in credit repair?

The next step in credit repair is to dispute incorrect information on your credit report.

What is considered good credit score?

Credit scores range from 300 to 850. A score of between 700 and 740, depending on the scoring method used, is considered “good credit” and usually enough to qualify you for the best credit cards and lowest mortgage rates. Related: How Credit Works: Understanding Your Report And Score. 2.

How does self build credit?

Self offers four different types of loans, each which you pay down monthly. At the end of the term, Self sends you back the initial term of the loan, minus interest and a small application fee. Each month you make a payment, they’ll report to good behavior to the credit bureaus and you’re credit score and profile will likely improve. The initial application may drop your credit score, but if you make all payments (to yourself) on-time, it should increase.